CANADIAN PROBLEMS

CANADIAN PROBLEMS

THAT INFRASTRUCTURE

INVESTMENT CAN SOLVE

July 2017

[Download original article as PDF]

The Power to Shape Policy & Of Our Newtwork

Get plugged in.

As Canada’s largest and most influential business association, we are the primary and vital connection between business and the federal government. With our network of over 450 chambers of commerce and boards of trade, representing 200,000 businessses of all sizes, in all sectors of the ecconomy and in all regions, we help shape public policy and decision-making to the benefit of all Canadians.

This report was made possible by the generous support of our sponsors

Title

Premier

Associate

TABLE OF CONTENTS

Introduction

Road Congestion in Large Cities

Facilitating Trade Through the Asia Pacific Gateway and Corridor

Positioning Canada to Excel in the Information Age

Realizing the Potential of Canada’s North

Enhancing the Quebec-Ontario Continental Trade Corridor

Getting Canada’s Oil and Gas to Global Markets

Green Electrification and Transmission

References

Introduction

Ten thousand years is how much additional time commuters in Toronto, Montreal and Vancouver spend stuck in traffic every single year as a result of road congestion from key bottlenecks in those cities. This severe congestion is an issue not just for businesses and residents of those cities, but for the entire Canadian economy. Highly focused infrastructure investments can help solve this problem and other major economic challenges that Canada faces.

In 2013’s The Foundations of a Competitive Canada, the Canadian Chamber of Commerce identified key principles of sound public infrastructure investment. The Chamber’s 2016 report, The Infrastructure That Matters Most, made the case for increased trade infrastructure investment to drive Canada’s international competitiveness.

What follows is an outline of seven problems in Canada that strategic public-private infrastructure investment can help solve.

Public infrastructure investment has been placed at the centre of the federal government’s economic plan through its commitment of $180 billion in new infrastructure funding over the next decade.

This funding will be accompanied by hundreds of billions of infrastructure dollars from provincial, territorial and municipal governments.

At the same time, the private sector continues to bring forward significant investments in Canada’ non-publicly owned infrastructure, including Canada’s telecommunications, pipeline and rail networks. While most of these projects do not seek public funding, they do require various government approvals through regulatory and other permitting processes.

There is an opportunity for the next decade of infrastructure investment in Canada to be truly nation changing by unleashing the private sector and targeting specific economic problems through public investment. The problems identified in this report are not the only problems in Canada that infrastructure investments should target, nor is infrastructure the sole means of solving them. However, they are important economic issues that demand federal focus to better prepare Canada for the economic, environmental and technological changes that lie ahead.

ROAD CONGESTION IN LARGE CITIES

The problem:

Annually, commuters in Toronto, Montreal and Vancouver are spending more than 10,000 years of extra time stuck in traffic due to congestion created by key bottlenecks.

Eighty-two per cent of Canadians live in urban areas of more than 90,000 residents, and this share is expected to increase to 88% by 2050.1 Canada’s urban growth is particularly concentrated in its largest cities, with over one-third of all Canadians, 12.5 million total, living in Toronto, Montreal and Vancouver.2 Inconsistent public infrastructure investment over extended periods of double-digit population growth rates in these cities has put pressure on their basic systems of infrastructure.

Transportation systems have especially struggled to keep pace with growth, creating challenges with how people and goods move around these regions. Gridlock and crowded public transit has become an everyday reality for businesses and their employees. This reality has economic and environmental costs. It increases greenhouse gas emissions, lowers employee productivity, increases the time to move goods and services to customers and lowers the quality of life of those experiencing it. It affects everyone from large manufacturers transporting products to a self-employed handyman trying to get to another job. It makes dynamic cities less livable and more frustrating.

Grinding to a Halt: Evaluating Canada’s Worst Bottlenecks, a Canadian Automobile Association (CAA) study developed by CPCS Transcom, provides insight into road congestion in Canada by identifying the worst highway bottlenecks in the country. It defines bottlenecks as the stretches of highway that are routinely and consistently congested throughout the course of a weekday. CAA found that of the top 10 bottlenecks in Canada, five are located in Toronto, three are in Montreal and two are in Vancouver. Grinding to a Halt also provides region-wide measures of congestion by examining how long an average weekday trip takes on area highways versus how long it would take under free-flow conditions as a result of these bottlenecks. It found that congestion in Toronto, Vancouver and Montreal is responsible for adding nearly 88 million hours annually to Canadians’ commutes. That is over 10,000 years’ worth of extra time every year that drivers in those cities are stuck in their vehicles.

Additional Annual Hours of Travel Time Compared to Free-Flow Traffic

| City |

Millions of Hours |

City |

Millions of Hours |

| Toronto |

51.6 |

Ottawa-Gatineau |

5.2 |

| Montreal |

26.3 |

Oshawa |

2.3 |

| Vancouver |

10 |

St Catharines |

1.5 |

| Calgary |

7.8 |

Regina |

1.1 |

| Edmonton |

6.2 |

Winnipeg |

1.1 |

| Quebec |

5.3 |

Halifax |

0.9 |

| Hamilton |

5.2 |

Total |

124.4 |

Source: Grinding to a Halt: Evaluating Canada’s Worst Bottlenecks. CPCS analysis of data provided by HERE and provincial/local departments of transportation.

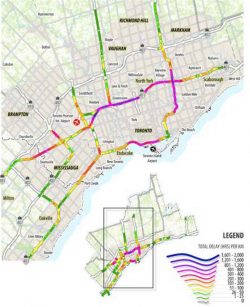

Toronto

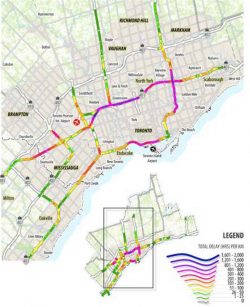

Source: CPCS analysis of data provided by HERE and provincial/local departments of transportation. Results first published in the CAA’s paper: “Grinding to a Halt: Evaluating Canada’s Worst Bottlenecks”

The Greater Toronto and Hamilton Area (GTHA) is the most congested region of the country. Grinding to a Halt found that Toronto has 10 of the top 20 bottlenecks in Canada, with the three worst being Highway 401 between Highway 400 and Yonge Street, the Don Valley Parkway and a stretch of the Gardiner Expressway. It also found that region-wide congestion due to these bottlenecks results in 52 million hours of additional travel time per year.

In 2006, the regional transportation authority Metrolinx pegged the annual costs of congestion in the region at $6 billion and estimated that, without significant transportation improvements, the annual costs would increase to $15 billion by 2030.3 In 2013, the C.D. Howe Institute assessed that the costs of congestion in the region were underestimated by $1.5-$5 billion by not including unrealized income when congestion deters people from visiting faraway businesses, sharing ideas face-to-face and taking on better paying jobs that require a longer commute.4

Expanded road and mass transit infrastructure are crucial to meeting the needs of the region’s economy. In November 2008, Metrolinx unveiled its long-term regional transportation plan, The Big Move: Transforming Transportation in the Greater Toronto and Hamilton Area. The plan calls for $34 billion in new transit and transportation projects including 1,200 km of new rapid transit and resolving bottlenecks in the road network. To date, $16 billion in projects have been funded.

Adding capacity to major transportation systems in densely populated areas is costly. Look no further than Toronto’s planned Scarborough Subway Extension that will add 6 km and one additional stop on the Bloor-Danforth subway line at an estimated cost of $3.2 billion. In the face of these kinds of costs, Toronto and Canada’s other large cities will need a renewed focus on improving the productivity of existing transportation infrastructure. Incentives to encourage off-peak travel and ride-sharing platforms can help cities use existing transportation assets more efficiently. Looking ahead, emerging technologies, such as autonomous vehicles, hold enormous potential to ease congestion.

Identifying continuous, ongoing funding for upgrades to the region’s transportation infrastructure is critical to ensuring congestion in Canada’s largest city does not become a bigger economic problem than it already is.

Montreal

Montreal’s Light Rail Mega Project

Major changes could be coming to the face of public transit in Montreal. A new project proposed by the Caisse de dépôt et placement du Québec will connect several suburbs and the Pierre Elliott Trudeau International Airport to downtown Montreal through 67 km of new light rail that would be operational in the early 2020s.

The $5.9-billion project is unique in that the Caisse will build, own and operate the system. The Caisse has pledged to commit $3.1 billion to the project and is looking to the provincial and federal governments to finance the remaining $2.8 billion. To earn a return on the project, the Caisse has proposed to receive a share of the enhanced property tax revenues generated by real estate developments along the light rail route.

Projects such as this will become more common as governments seek to leverage private sector expertise and risk management for large, complex projects through Public Private Partnerships and other alternative financing mechanisms.

Grinding to a Halt found that Montreal had five of the top 20 bottlenecks in Canada, and as a result, Montreal-area residents spend 26 million additional hours in traffic every year.

In addition to needing greater capacity, Montreal is grappling with existing road infrastructure that is crumbling due to decades of inadequate maintenance. The mayor of Montreal recently stated that 45% of the 4050 km of roads in the city need either urgent or immediate repair.5 In Montreal’s current maintenance plan, the city will be working on 676 km of road per year over the next several years, a significant increase over the 2015 total of 295 km.6

While this repair work is long overdue, businesses and employees in Montreal will suffer the consequences through construction-disrupted commutes. A recent study in Quebec showed that 78% of businesses surveyed said road repairs have had a significant impact on employee management and one-third of companies said construction-related delays have resulted in employees quitting or turning down jobs.7 For Montrealers already tired of construction delays, it is going to get worse before it gets better.

Vancouver

Grinding to a Halt found that Vancouver has four of the top 20 bottlenecks in Canada, which result in an additional 10 million hours of extra travel time each year. Unlike Toronto and Montreal, Vancouver has no expressways serving its downtown core, which also means vehicles are jammed onto smaller streets and move at slower speeds.

The economic impacts of congestion in the Lower Mainland extend far beyond those living and working in the Metro Vancouver area. With an increasing amount of Canada’s trade destined for Asian-Pacific countries moving through the Port of Vancouver, congestion in the Lower Mainland impacts the competitiveness of businesses that rely on the efficiency Canada’s Asia-Pacific Gateway to export their goods. Previously, the federal Asia-Pacific Gateway and Corridor Initiative (APGCI) provided strategic infrastructure investments to improve the flow of goods through the Lower Mainland. Many stakeholders in Metro Vancouver and others outside the city that depend on the Gateway are asking the government to re-establish this collaborative infrastructure program to better ensure regional goods and commuter movement strategies and investments are aligned.

Source: CPCS analysis of data provided by HERE and provincial/local departments of transportation. Results first published in the CAA’s paper: “Grinding to a Halt: Evaluating Canada’s Worst Bottlenecks”

Translink is the authority responsible for regional transit, cycling and commuting in Metro Vancouver while sharing responsibility for the major road network with municipalities in the region. In 2014, the Metro Vancouver Mayors Council released a 10-year transportation and transit plan that included an estimated $7.5 billion in new capital spending projects for Translink. The plan led to a plebiscite in 2015 on whether to increase regional sales taxes to help finance transit projects. Following a heated campaign, the measure was rejected by residents, and in November of 2016, the Mayors Council had to approve increases to property taxes and transit fares to finance the municipal share of projects. It was instructive of the challenges Canada’s large cities face trying to balance their increasing transportation demands and residents’ willingness to finance them.

Three Good Ideas…

Prioritize investments in transportation capacity where it is needed most. The federal government has committed to add capacity to transit systems through an 11-year, $25-billion public transit fund that will be coupled with provincial and municipal transit funding. Considering the high costs of congestion, federal allocations should be determined through a needs-based approach that focuses on large cities with the greatest congestion challenges.

Improve the management and maintenance of transportation assets. Approximately 80% of the public roadways in Canada are owned by municipal governments and the maturity of transportation asset management systems of these governments varies significantly.8 Through its infrastructure programs the federal government should require better asset management practices, including full lifecycle cost accounting for municipal transportation projects. Improved and consistent municipal capacity will help communities improve infrastructure investment decisions and ensure new projects are maintained as long-term investments.

Foster transportation innovation to reduce congestion on existing infrastructure. The federal government should use infrastructure investments and other policy levers to improve the productivity of existing transportation assets. This could include creating incentives under new infrastructure funding programs to encourage congestion pricing or similar mechanisms can spread out demand on transportation infrastructure. The government should also start developing flexible regulatory frameworks that encourage private sector investment in technologies that have significant potential to reduce congestion, including carpooling platforms and autonomous vehicles.

FACILITATING TRADE THROUGH THE ASIA PACIFIC GATEWAY AND CORRIDOR

The problem:

There is insufficient coordination of public-private trade-enabling infrastructure investment in Canada’s vital Asia-Pacific transportation networks.

Twenty per cent of Canada’s trade by value travels through the Asia-Pacific Gateway along the coast of British Columbia, primarily through the Ports of Vancouver and Prince Rupert, which are crucial entry and exit points for Canadian goods moving to and from the Asian-Pacific region. Containerized and bulk commodity exports move to the ports through a multi-modal trade corridor comprised of thousands of kilometres of highways and Class 1 and short-line railways that extend through British Columbia, the Prairies and the U.S.

Source: CPCS analysis of internal list of Canadian transportation assets (CPCS GIS database)

The efficiency and reliability of these transportation networks are critical to Canadian companies’ ability to integrate into global supply chains. For a trading nation like Canada, the strength of its economy is closely linked to the strength of its trade corridors. This importance was recognized at the federal level in the mid-2000s through the creation of the Asia Pacific Gateway and Corridor Initiative (APGCI), a program designed to provide funding for critical trade infrastructure projects that reduce supply chain bottlenecks and other barriers to trade through Canada’s west coast. Through the program, Transport Canada and other federal departments negotiated infrastructure investments that included the private sector and other levels of government to fund multiple projects along Western Canadian Transportation Infrastructure supply chains. The convening nature of the program was a powerful catalyst for investment. According to Transport Canada, federal funds of $1.4 billion leveraged $3.5 billion in total project funding, and the investments had a spinoff effect in private investments exceeding $14 billion.9

Despite strong industry support for the initiative and the dozens of strategic multi-modal projects that were funded across the corridor as far east as Winnipeg, no additional funding was provided for APGCI when a new a federal infrastructure framework was announced in 2013-14. Following its expiry, APGCI was endorsed in the 2016 report of the Canadian Transportation Act Review that found “the gateway approach of linking trade and transportation together in an integrated, multi-modal and public-private strategy was widely recognized as a Canadian best practice.”

Although lower export volumes as a result of the recent economic slowdown eased some pressure on the Gateway and Corridor, long-term forecasts point to the need for a significant capacity expansion. Major Asian-Pacific economies will be the fastest growing export markets for Canadian goods in the decade ahead. Canada’s goods exports to China, already Canada’s second largest trading partner, are forecasted to grow at 12% per year between 2021-2030. Goods exports to India are expected to grow at 11% per year over the same period.10 As a result of this strong pull for Canadian goods, containerized shipments through the Gateway are expected to grow 4.8% annually through 2025.11

The Canadian Transportation Act Review drew particular attention to global demand for Canadian commodities. In addition to recommending the renewal of the overall initiative, it pointed out that APGCI had a prominent focus on containerized goods and that a renewed initiative should also include a focus on bulk commodities.

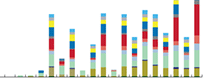

Canada’s Top Six Bulk Commodity Exports via Rail for 2013 and 2045

Petroleum, iron ore, coal, grain/oilseeds, wood products, potash volume in tonnes.

Source: CPCS analysis of HIS World Trade Service Data

A CPCS Transcom forecast of Canada’s top six bulk exports (representing over 60% of the traffic currently carried by Canadian railways) projects that rail in Western Canada will need to nearly triple its capacity from 74 to 217 million tonnes of cargo between 2013 and 2045. British Columbia ports will see their demand for movement of these commodities triple from 89 to 259 million tonnes between 2013 and 2045.

There is no shortage of investment underway to expand the capacity of the Gateway and Corridor. Port of Vancouver is already the busiest and largest port in Canada and third largest port in North America, moving 136 million tonnes of cargo worth over $200 billion in 2016. There are a number of container terminal expansion projects being considered or already underway that will add to the port’s existing three million twenty-foot equivalent units (TEUs) capacity. Global Container Terminals (GCT), which operates the Vanterm and Deltaport container terminals, has started a $300-million project to reconfigure the Deltaport intermodal yard that will add 600,000 TEUs of annual capacity in 2017. A planned expansion to the Dubai Ports World-operated Centerm would also add 600,000 of additional TEUs by 2020. Vancouver Fraser Port Authority is also seeking private sector investors/operators and environmental approvals for its Roberts Bank Terminal 2 project that would add another 2.4 million TEUs of annual capacity by 2024. On the bulk side, G3 is moving forward on a new grain terminal, the first in the port in decades. As these projects move forward, they are accompanied by concern about the shortage of available industrial land in the lower mainland and how congestion in the region will impact the port’s continued growth.

Seven hundred fifty kilometres north of Vancouver is the Port of Prince Rupert, Canada’s fifth largest and fastest growing port, which moved 20 million tonnes of cargo in 2015. Prince Rupert has an advantageous location, being the closest port to China in North America. The port is also unobstructed by urban development and has excess land available for development, which positions it well to accommodate future expansion. Prince Rupert Port Authority is in the process of adding to its annual capacity of 775,000 TEUs through an expansion of its Fairview Terminal, which is expected to bring the port’s capacity to over 1.3 million TEUs in 2017.

There are also new projects being proposed to add capacity and resiliency on the west coast. The Port Alberni Port Authority has proposed to develop a new large-container trans-shipment hub (the Port Alberni Transshipment Hub or PATH) in the Alberni Inlet on Vancouver Island. The proposal suggests that barging containers to distribution centres along the Fraser River from a Vancouver Island hub to the Lower Mainland could help address capacity needs and ease road congestion in the Lower Mainland. It is driven by the idea that the waterways, which follow many of the local roadway routes in the Lower Mainland, could be better used to more efficiently move goods in the region.

Source: CPCS analysis of internal list of Canadian transportation assets (CPCS GIS database)

As seaports add capacity, there is a need for Canada to expand other cost-effective and sustainable locations to support improving supply chain efficiency. Improving marine port throughput with the use of an inland port is one strategy being employed by major ports around the globe to reduce congestion, pollution and land costs. One such opportunity for Canada is the established Ashcroft Terminal, the closest inland port to Vancouver. Roughly 340 km away, Ashcroft is positioned to serve as a bulk, break-bulk and intermodal transportation hub for the Gateway given its proximity to CP and CN main lines and major British Columbia highways. By processing shipments inland, closer to British Columbia and Canada’s natural resource producers, Ashcroft is in a strategic position to stage goods away from the congested Lower Mainland so that shipments can move through Metro Vancouver for export as seamlessly as possible. As the Lower Mainland grapples with increased demand and congestion, shippers may look more at the inland containerization of export products to help ease the flow of goods, reduce truck traffic and convert truck to rail shipments closer to source. Further in the interior, other inland ports, such as CenterPort in Winnipeg, can serve as a supply chain connection points between Canada’s Asia-Pacific, Continental and Atlantic trade corridors.

With so many moving pieces, Canada’s international trade competitiveness is dependent on bringing together a diverse set of public and private supply chain participants. Complex transportation and logistics networks can be best enhanced when infrastructure and policy decisions are made within the context of the entire network rather than any individual component.

In the absence of federal coordination that was previously provided under APGCI, there are several working groups and organizations contributing to collaborative analysis and decision-making. The Gateway Transportation and Collaboration Forum (GTCF)12, has worked to identify priority projects for federal infrastructure funds, but is looking only at Lower Mainland projects. Other organizations, many sharing common members that are working on gateway and corridor analysis, include the Van Horne Institute, the Western Transportation AdvisoryCouncil (WESTAC), The Pacific Gateway Alliance, and the Greater Vancouver Gateway Council.

Many of these supply chain participants agree the federal government should resume a leadership role, informing and incentivising investments across the entire Gateway and Corridor. As one west coast executive put it, “these organizations are all integral parts of the orchestra, but there is no conductor up front.” Some stakeholders are also concerned that, without the APGCI structure, some public infrastructure projects that will unlock follow-on private sector investments are being delayed. Surmised one CEO, “international trade through the Asia Pacific Gateway and Corridor is a federal issue that needs to be federally driven.”

Three Good Ideas…

Increase strategic trade gateway and corridor investments. The federal government recently announced a $2 billion, 11-year National Trade Corridors Fund. While the funding is welcome, more federal dollars should be allocated to strategic infrastructure investments across Canada’s Asia-Pacific, Continental and Atlantic trade corridors. Building on the experience from APGCI, priorities for the new fund should be determined through collaboration with the private sector and by using merit-based project selection to attract increased domestic and foreign investment and achieve the maximum yield from public dollars. The government should support these decisions by re-establishing gateway and corridor analytical capacity within Transport Canada.

Improve supply chain data collection and sharing to support trade infrastructure investments. Public and private information silos can lead to an inconsistent understanding of the “full picture” of how goods move. Transportation infrastructure investment at all levels of government and within the private sector would be better informed through a collaborative Canadian effort to collect, analyze and share data will help identify bottlenecks, support supply chain innovation and prepare for future growth. The new Canada Infrastructure Bank holds potential to help fulfil this role as does the new Trade and Transportation Information System that is being set up by Transport Canada. Joint public-private advisory boards or similar structures will encourage greater private sector collaboration in data collection and help shape decision-making by depoliticizing investment decisions.

Increase federal leadership in identifying and tackling policy and regulatory barriers to goods movement. A renewed federal focus on trade gateways and corridors must take comprehensive approach to goods movement and tackle issues that impact the efficient movement of goods to global markets. This includes issues such as overall supply chain performance, transportation system policies and regulations, labour issues, international marketing, interprovincial trade barriers and the role of private sector and institutional investors in infrastructure investments. A systematic effort to quantify and address these issues will help drive measurable improvements in Canadian supply chains.

POSITIONING CANADA TO EXCEL IN THE INFORMATION AGE

The problem:

Canada’s telecommunications infrastructure requires significant ongoing capital investments for Canadian companies to take full advantage of the expanding digital economy.

Amongst the continuing change and uncertainty in the global economy, one certainty is the role of digitization, big data and rapid technological change will continue to permeate all aspects of how business is conducted. The McKinsey Global Institute found that in 2014, global digital flows, primarily consisting of information, searches, communications, transactions, video and intracompany traffic exerted a larger impact on the world’s GDP than trade in goods.13 As Alec Ross, author of The Industries of the Future puts it, land was the raw material of the agricultural age, iron was the raw material of the industrial age and data is the raw material of the information age.

The ability of Canadian companies to use and benefit from these global data flows depends on the quality of Canada’s digital infrastructure and the regulatory environment that governs it. Canadian companies have largely benefited from Canada’s robust digital networks, attributable to good wireless and wire line networks because of billions of dollars of private sector capital investments. As a result, over 96% of Canadians have access to broadband download speeds of at least five megabits per second.14 Unlike some countries, Canada’s digital and telecommunications infrastructure has not required large public sector investments.

Canada Projected Growth Between 2015-2020

|

| Overall Internet Traffic |

+270% |

| Business Internet Traffic |

+240% |

| Overall Mobile Traffic |

+600% |

| Business Mobile Traffic |

+500% |

|

| Source: Cisco Mobile Visual Networking Index Service Adoption Forecast Tool, http://www.cisco.com/c/m/en_us/solutions/service-provider/vni-forecast-highlights.html# |

However, not all Canadians and companies have benefitted equally from connectedness. Canada’s geography results in coverage gaps, particularly in rural and northern areas where it is not economical for telecommunications companies to make large investments to serve small numbers of Canadians. Notwithstanding advances in satellite and cellular technology, businesses in many rural and remote communities rely on internet and cellular connections with much slower speeds and higher costs than those in urban centres.

Low or no bandwidth results not only in lost productivity but stifles data innovation and prevents businesses from taking advantage of all the new opportunities of economic activity migrating online. Market forces are not sufficient to bring reliable, high-speed connectivity to these communities, and there is a need for public investments and incentives to continue improving the reach of Canada’s digital infrastructure. Without bridging this digital divide, businesses in rural and remote communities will become even more economically isolated from the rest of the country.

In addition to bringing more connectivity to rural and remote areas, the ability of Canadian companies to take advantage of global data flows will be driven by the ability of the private sector to continue modernizing its existing infrastructure.

Availability of Broadband Internet Service above 5 Mbps Download

Source: Canadian Radio-television and Telecommunications Commission, Broadband Internet Service Coverage in Canada (accessed February 2017)

This map shows the availability of broadband internet access in Canada at or above speeds of 5 Mbps at the end of 2014. Green areas are served with fixed wireless, DSL/fibre and cable connectivity. Yellow areas are primarily non-urban where 4G cellular service is being used to achieve 5 Mbps, although it is not always as reliable as fixed wire connectivity.

In December of 2016, the Canadian Radio-Television and Telecommunications Commission (CRTC) established a new universal service objective of 50 Mbps download and 10 Mbps upload speeds, which the Commission views as the level of service Canadians require to participate in the digital economy. The CRTC found that 2.4 million Canadians do not have access to these speeds and announced that a new fund of $750 million will be established to support projects where that level of service is not available.

Shortening technology cycles and exponential growth in bandwidth demand have necessitated substantive capital investments to keep Canadians as full participants in the digital economy. This is evidenced by the more than $14 billion in capital investments made by Canadian telecommunication companies in 2015.15

Furthermore, the lines between computing and telecommunications is blurring as telecommunications companies are cultivating new digital offerings in the areas of cloud services, the Internet of Things and data analytics. A global survey of major telecommunications firms found that over a third of companies expect digital services will account for more than one-fifth of their revenues by 2020.16

One instance where public policy has not kept pace with the rate of change in the sector is the Capital Cost Allowance (CCA) for telecommunications assets. The CCA is the extent to which a company can claim depreciation expense when calculating taxable income meant to reflect the useful economic life of an asset. The current CCA rate for some telecommunications equipment is 30%, whereas computer equipment and systems depreciate at a rate of 55%, reflecting their high rate of technological obsolescence. In reality, some of today’s data network infrastructure has a lifespan more comparable to computing devices, and companies can no longer use telecommunications assets as long as they used to. Adjusting this federal tax measure to reflect the useful life of this infrastructure would spur increased network investments. The Conference Board of Canada estimates that a permanent change to a CCA depreciation of 50% for data network infrastructure would increase real capital investment by the telecommunications industry by approximately $225 million per year.17

The next major development in network technology will be the deployment of fifth-generation cellular services (5G). 2G, 3G and 4G were primarily directed at the consumer market, allowing Canadians to connect to the internet from their mobile devices at increasing speeds. 5G, which is expected to be deployed in the early 2020s, will be exponentially faster than 4G (estimates range between 10 and 100 times faster). Many consumers may not need the ultra-high speed that 5G provides. However, the speed and low latency will help usher in an ultra-connected future through new business and public sector applications that will invade every industrial and social sector across developed economies. Real-time data transfer and increased cloud computing capacity will drive improved efficiency and innovation through various new applications.

Many advanced economies are looking at 5G as an opportunity to drive increased productivity. Although the private sector is leading the development of the technologies needed to deliver 5G, governments will play a key role through the provision of wireless spectrum (the airwaves wireless signals travel on). Its regulation and distribution is tightly controlled by government and auctioned to telecommunications providers. For Canada to capitalize on the opportunities provided by 5G, the federal government should ensure there is enough mobile radio spectrum available to telecommunications providers and that the cost of that spectrum is in line with the cost in similar jurisdictions. This includes the more than $170 million annually the federal government currently requires telecommunications service providers to pay in spectrum licence fees. If the government-imposed costs of this ”invisible infrastructure” is excessively high, it will impact the amount of capital available for providers to invest in the rest of their networks.

Three Good Ideas…

Increase public infrastructure investments in rural and remote connectivity. The federal government should prioritize and accelerate public investment in digital connectivity for rural and remote communities as part of its infrastructure agenda. These investments should be done in consultation with telecommunications providers and in a manner that limits the distortion of competitive markets as much as possible. Governments can also facilitate greater private sector investment in remote areas by providing updated mapping of existing telephone and utility infrastructure in rural areas.

Update tax incentives for private investments in telecommunications infrastructure. The federal government should increase the Capital Cost Allowance (CCA) rate for telecommunications equipment to 50%, reflecting the reality of rapid changes in the technology. Updating the CCA will stimulate hundreds of millions of dollars in new private sector investments in Canada’s digital infrastructure.

Ensure Canadian companies can benefit from opportunities presented by 5G. To ensure Canadian companies are at the forefront of 5G innovation, the federal government should ensure enough spectrum is available to telecommunications providers to support 5G traffic. The federal government should also ensure that the cost of that spectrum is not prohibitive.

REALIZING THE POTENTIAL OF CANADA’S NORTH

The problem:

Many northern Communities in Canada still lack some of the basic infrastructure that makes it possible for business to succeed and thrive.

Canada’s territories occupy 40% of the country’s landmass while being home to roughly 110,000 residents, only 0.03% of Canada’s population. North of the 60th parallel has some of the most beautiful and unforgiving geography in the world, making it a complex and costly environment in which to build and maintain the most basic infrastructure.

For the federal government, it can be difficult to justify expensive projects that benefit small, spread out populations. Decades of insufficient investment has resulted in severe infrastructure needs that are much greater than the funding available through existing per-capita infrastructure programs. These infrastructure deficits impact every facet of daily life for residents. It limits investment in the North and prevents Canada from realizing the full economic and social benefits of the North’s resource development potential.

Pangnirtung Air Access

Pangnirtung is a community of 1,425 in Nunavut that is accessible only by a short, 900-metre runway that runs through the middle of town. The runway length restricts the size of aircraft and payloads that can land at the community.

As one northern air carrier has been upgrading its fleet, performance limitations of its newer model aircraft do not permit operations on the short runway. While the carrier continues to maintain older aircraft to fly into Pangnirtung, soon it will need to retire those aircraft for maintenance cost and safety reasons.

Without a new or extended runway that can accommodate newer planes, businesses and residents will lose flights from the carrier, increasing the cost of moving people and cargo to Pangnirtung and limiting the economic development potential of the local fishery and tourism to nearby Auyuittuq National Park.

Air Transportation

Climate, large distances and small populations conspire to limit road infrastructure in the North. Where there are roads, many are unpaved or are temporary ice roads. As a result, air travel is a vital link for moving to, from and around the North. Some northerners describe air transportation as the “trans-Canada highway of the North.”

The reliance on air can be appreciated by examining the difference in aviation trips per capita between northern and southern communities. In 2006, Iqaluit, with a population of 6,000 had over 110,000 air travel passengers enplane and deplane, averaging nearly 18 aviation trips per capita, the highest ratio in the country. Yellowknife was second highest, at 15 aviation trips per capita. In comparison, Toronto and Vancouver averaged 5.8 and 7.7 aviation trips per capita respectively.18

Despite the reliance on air travel in the North, many northern airports lack the basic infrastructure that would make air transportation safer and more affordable. One major cost driver for northern carriers is that flights are often diverted or turned around due to bad weather before landing because carriers do not have accurate weather information for destination airports. In addition, many northern runways are only equipped with the most basic approach lighting systems which limits pilots’ ability to land in what would otherwise be safe conditions. The extra expense of flights that are turned away from their destination is built into cargo and ticket costs and ultimately borne by the economies of northern communities. Relatively inexpensive investments to improve weather and runway guidance systems at airports across the North would lower costs and increase the safety and reliability of northern air travel.

Clean Electrification

Many remote and northern communities across Canada are not connected to major electricity grids and, instead, rely on diesel generation. Diesel-generated power is not only harmful to the environment through local air pollution and GHG emissions but also through emissions related to transporting the fuel long distances and ground pollution due to spills and leaks. It is also expensive. Electricity costs in some northern communities have been over 10 times higher than the Canadian average on a per kilowatt-hour basis while per capita energy use in the North is almost twice the Canadian average.19

There are short- and long-term solutions on the horizon. Opportunities exist to upgrade existing diesel generators to make them more efficient. Liquefied Natural Gas (LNG), which is cleaner and less expensive than diesel, is emerging as an alternative for some communities. Since 2013, the community of Inuvik, Northwest Territories has been trucking in LNG over 3,600 km (further than Thunder Bay to Vancouver) from a FortisBC Liquefied Natural Gas plant in Delta, British Columbia to provide cleaner and cheaper electricity to the community. Whitehorse has also recently built new gas generators to provide backup and peaking power to the city.

Renewable sources of energy are also becoming more practical for isolated communities. Smart micro-grid technology can optimize the use of renewable power with existing diesel generation. Several northern communities are close to potential hydropower sites, and other renewable sources will become more attractive as storage technology improves in the coming years. Looking further ahead, the development of small nuclear reactor technology may be an option for reliable, cleaner electricity in some communities.

Capital investments in many of these new, cleaner energy sources will be costly. The federal, provincial and territorial governments have shown an increased interest in tackling this challenge through the December 2016 Pan-Canadian Framework on Clean Growth and Climate Change, which committed to “…accelerate and intensify efforts to improve the energy efficiency of diesel-generating units, demonstrate and install hybrid or renewable energy systems and connect communities to electricity grids.”20 In addition to the environmental and economic benefits to businesses and northerners, more affordable and reliable electricity sources can help reduce one barrier to new resource projects in the North. Northern communities will be watching closely to see if capital commitments follow the intentions expressed by governments.

Digital Connectivity

For the same reasons it is difficult to connect northerners physically to the south, it is difficult to connect them digitally. The high cost of telecommunications infrastructure results in internet and cellular service that is significantly slower, more expensive and less reliable than in the rest of Canada.

In addition to higher costs to businesses, northerners must grapple with lost productivity as a result of slow speeds. The quality of a community’s broadband service also affects businesses’ ability to attract and retain skilled workers.21 In Nunavut, internet packages cost hundreds of dollars per month for 3-5 Mbps download speeds and 30-50 gigabyte download caps. Comparable packages in other parts of the country cost $40-$50 per month. While service providers continue to improve their offerings, the costs and market size do not support large-scale private sector capital investment.

In December 2016, the Canadian Radio-Television and Telecommunications Commission (CRTC) ruled that broadband service with download speeds of at least 50 Mbps would be considered a basic telecom service. The CRTC also announced it would start a public/private investment fund of up to $750 million over five years to fund projects in areas that do not meet these targets. This funding follows previous and current federal funding programs that have committed hundreds of millions of dollars and made incremental, but still insufficient, improvements to northern connectivity.

In the absence of significant capital investments, northern connectivity will remain caught in a perpetual state of “catch-up” that will leave northerners digitally isolated and unable to fully participate in the economic opportunities of the information age.

Three Good Ideas…

Increase federal infrastructure funding for the North. Per capita-based federal funding programs are not sufficient to meet the infrastructure needs of the businesses and residents in the North. In 2016, the federal government announced it would allocate $2 billion over 11 years for rural and northern infrastructure. While this commitment is welcome, more funding should be set aside to meet the unique needs of the North in the context of a $180-billion infrastructure plan.

Better coordinate infrastructure investments in the North. There are many proposed port, airport, road, pipeline, rail, fibre optic, electrical transmission and other infrastructure projects that are all competing for funding across the territories. Rather than being considered as one-off decisions, investment proposals for northern projects would benefit from greater cross-territorial collaboration through a formal mechanism to ensure limited infrastructure dollars have the greatest economic and social impacts across the entire region. For example, upgrading airport weather information systems and runway guidance lights for all northern airports could be done at less cost than a single large-scale infrastructure project and would provide economic benefits across the territories.

Incentivize investment in the North through the Canada Infrastructure Bank. As the federal government stands up the Canada Infrastructure Bank it should ensure that the bank’s mandate includes a specific focus on facilitating public-private investment in strategic infrastructure projects that could help unlock new economic opportunities in the North.

ENHANCING THE QUEBEC-ONTARIO CONTINENTAL TRADE CORRIDOR

The problem:

Canada’s transportation networks from Ontario and Quebec into the U.S. require increased capacity to support the long-term global competitiveness of North American manufacturers.

Ontario and Quebec generate over 70% of Canada’s total manufacturing revenue.22 Although manufacturers in these provinces have customers around the world, the sector largely serves the U.S. market with over three-quarters of Canadian manufacturing exports destined to Canada’s largest trading partner. A significant portion of that trade is intermediate production and intracompany trade as a part of highly integrated, just-in-time supply chains clustered in the Great Lakes region.

Goods move to and from manufacturers in the Montreal area and southern Ontario through a multimodal transportation system linked into the U.S. heartland. While these transportation networks to the U.S. support freight movement by water, rail and air, truck is the dominant form of transportation. This reliance on trucking leaves regional trade vulnerable to highway congestion and processing and security delays at the Canada-U.S. border. While manufacturing in Canada has faced a long-term decline as a share of Canada’s overall economic output, improving the efficiency of Canada-U.S. supply chains can help ensure Canada’s remaining manufacturers remain competitive.

In 2007, following the example set by the Asia-Pacific Gateway and Corridor Initiative (APGCI), the governments of Canada, Ontario and Quebec signed a memorandum of understanding (MOU) to develop an Ontario-Quebec Continental Gateway and Trade Corridor Strategy. Its objective was to support upgrading transportation networks into the U.S. to help drive increased trade through a comprehensive infrastructure, policy and regulatory plan. While the MOU led to cross-jurisdictional analysis in a number of areas, a strategy never materialized.

The challenges that led to the need for a strategic approach in 2007 still exist. In its 2015 submission to the Canadian Transportation Act Review, the Government of Quebec expressed support for an integrated plan, recommending that “the federal government should recognize the importance of the Ontario-Québec Continental Gateway and Trade Corridor in international exchange and… [resume] the work and update the analyses and the Strategy… to ensure its implementation.”23

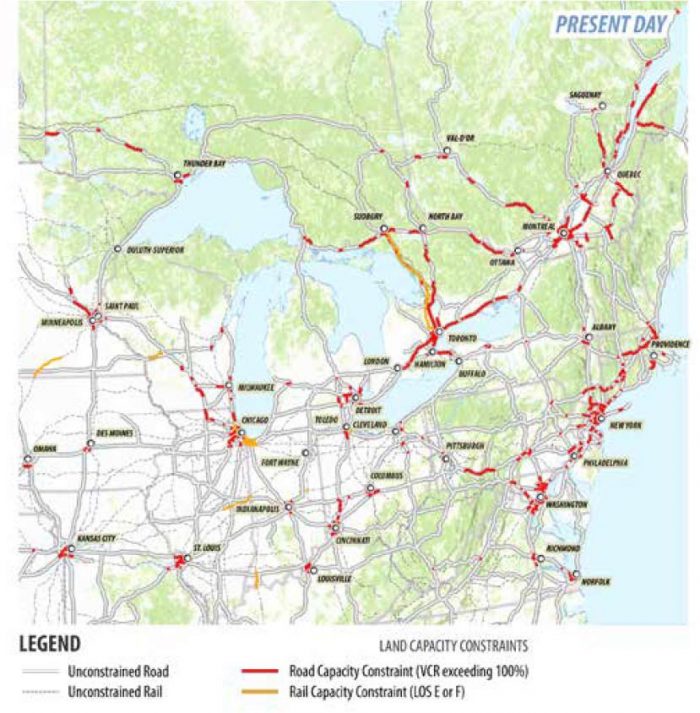

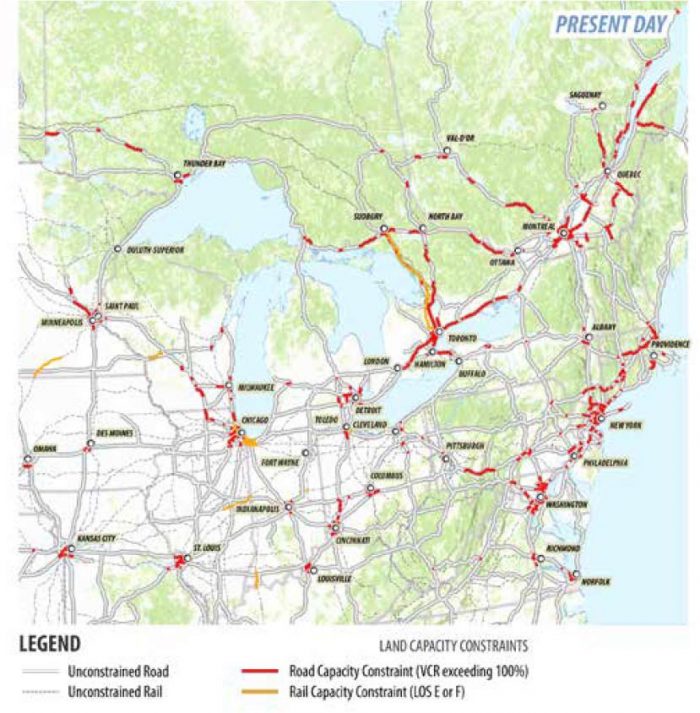

Ontario/Quebec Land Capacity Constraints – Road and Rail Capacity Constraints

Source: CPCS analysis of FHWA, Statistics Canada-Transport Canada ICORRIDOR traffic information utilizing FHWA Greenbook parameters for Capacity. Results first published in the TRB’s Report: “Multimodal Freight Transportation Within The Great Lakes – Saint Lawrence Basin”.

Canada’s manufacturing trade will continue to generate new long-term demand on the transportation systems in these regions. By one measure, volume capacity ratio (VCR), several major highways in Quebec and Ontario are currently experiencing capacity constraints. VCR is an index used that assesses the volume of traffic on a highway against its capacity. A highway operating at 100% VCR is operating at full capacity, and one operating at greater than 100% is operating above capacity and experiencing congestion. Current capacity problems are most acute around the Greater Toronto and Hamilton Area (GTHA) and Montreal, the two most congested regions in Canada. These constraints disrupt commuter and freight movement, problems sorely familiar to businesses moving goods through these regions. They point to a pressing need for transportation system upgrades to deal with congestion issues that are affecting many companies close to their manufacturing and distribution facilities.

Ontario/Quebec Gateway Land Capacity Constraints – Road and Rail Capacity Constraints

Source: CPCS analysis of FHWA, Statistics Canada-Transport Canada ICORRIDOR traffic information utilizing FHWA Greenbook parameters for Capacity. Results first published in the TRB’s Report: “Multimodal Freight Transportation Within The Great Lakes – Saint Lawrence Basin”.

Forecasting capacity constraints by 2040 on current regional networks paints a daunting picture of how existing infrastructure will be unable to accommodate transportation demand over the next 15 years. Many of the major highways on both sides of the border will be operating at excess capacity. While freight railroads will make appropriate investments to ensure appropriate capacity, protecting corridors and land for future rail capacity expansion will be required.24 Without enhanced capacity, the additional time and cost to move goods anywhere in the region and between countries will make North American manufactured goods more expensive and less competitive in global markets.

Increasing capacity for bi-national transportation and border infrastructure includes an additional layer of political complexity. Canada’s busiest border crossings are located in Ontario and Quebec with truck traffic most concentrated in a few key crossings around Lake Ontario, including the Detroit-Windsor Crossing. Detroit-Windsor, the busiest land border crossing in North America is anchored by the Ambassador Bridge, which has more than $250 million in commodities in roughly 8,000 trucks travelling across it each day.25 Trucks face significant congestion and delays at the crossing due to the high volume of traffic, limited capacity and the bridge’s location in downtown Windsor with no highway access.

In the early 2000s, governments on both sides of the border started working on a strategy to meet the region’s transportation demands, resulting in a proposal to construct a new six-lane, publicly owned span between Detroit and Windsor, later named the Gordie Howe Bridge. Since it was first proposed, the estimated $4.5-billion project has been beset by numerous delays. Following environmental approvals in 2009, in 2010 the Government of Canada had to agree to finance Michigan’s portion of the bridge (to be repaid through tolls) to accelerate its construction. The formal procurement process for the Gordie Howe Bridge was launched in 2015 with a target completion date of 2020. Procurement setbacks have further delayed the completion to 2021 or 2022. With 25% of all Canada-U.S. trade moving across the Ambassador Bridge, construction of the Gordie Howe Bridge is widely considered the single most important infrastructure project in Canada. Despite its economic importance, it will have taken nearly 20 years to complete the project by the time it opens.

Canada and the U.S. is the only major trading bloc in the world that does not have an infrastructure bank or similar agency to help plan, finance and build cross-border infrastructure. In their paper Some Assembly Required, the Canada West Foundation and the George W. Bush Institute recommend the creation of a North American Border Infrastructure Bank to support the building of border infrastructure between Canada and the U.S. Given the challenges with bi-national projects, such as the Gordie Howe Bridge, a new approach to planning and financing border infrastructure projects is worth exploring.

Three Good Ideas…

Reinvigorate a coordinated approach to the Continental Trade Corridor. The federal government recently announced a new $2 billion, 11-year National Trade Corridors Fund which can help fund collaborative infrastructure projects along the Continental Trade Corridor. The federal government should also help inform public-private investments through the collection and analysis of more Canada-U.S. supply chain data through federal instruments such as the Canada Infrastructure Bank and the Trade and Transportation Information System.

Avoid further delays in the construction of the Gordie Howe Bridge. The federal government should use all means available to advance and complete construction of the largest and most important border infrastructure project between Canada and the U.S. Once completed, the new bridge will help create new jobs and improve competitiveness of businesses on both sides of the border.

Consider new approaches to financing border infrastructure. The federal government should ensure that the new Canada Infrastructure Bank can be utilized to support the efficient planning and financing of integrated Canada-U.S. supply chains and cross-border infrastructure.

GETTING CANADA’S OIL AND GAS TO GLOBAL MARKETS

The problem:

Delays in regulatory approval processes are limiting the private sector’s ability to build new pipeline infrastructure and move Canada’s oil and gas resources to domestic and global customers.

Canada is an exporting nation. It has always produced more than it consumes to the betterment of the country and to other nations that benefit from these goods and services. Canada’s ability to bring its oil and natural gas resources to the U.S. and other parts of the world has helped generate wealth and an enviable standard of living for Canadians by creating hundreds of thousands of good paying jobs and billions of dollars in tax revenues and royalties for governments.

Most of Canada’s oil and gas exports move through pipelines, the safest and most efficient way to transport them. On average each year, 99.999% of the oil transported on federally regulated pipelines moves safely.26 However, in recent years, a troubling trend of project approval delays have set and hindered the private sector’s ability to expand Canada’s pipeline infrastructure so these resources can be brought to new markets.

Natural Gas

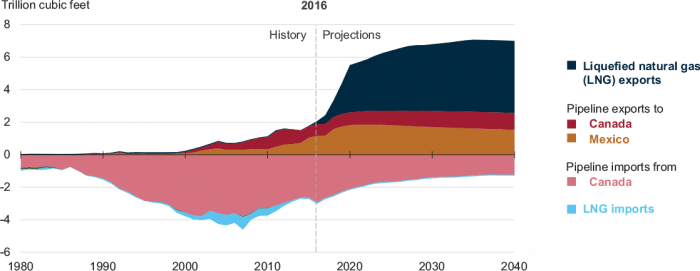

The U.S. shale boom, which started in 2006 and reached its peak in 2012, has transformed North American natural gas markets and the competitive landscape for Canadian producers. Canadian exports have been driven out of several U.S. markets, and low-priced natural gas from the northeast U.S. is starting to displace Canadian gas in eastern Canada. In addition to increasing the sale of gas to Canada, the U.S. is exporting more abroad, supported by the 2016 opening of its first liquefied natural gas (LNG) export terminal in the contiguous U.S.

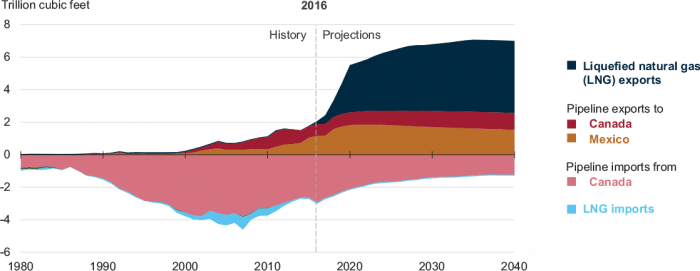

United States Natural Gas Trade – Annual Energy Outlook 2017

Source: U.S. Energy Administration, Annual Energy Outlook 2017

In the face of significantly increased North American supply and U.S. competition, it is critical for Canadian producers to access new international markets. Unfortunately, Canada’s landlocked natural gas does not yet have the pipeline infrastructure and LNG facilities to export to Asia and other parts of the world.

In 2011, LNG Canada (a consortium of Shell Canada and affiliates Mitsubishi Corporation of Japan, Korea Gas Corporation and PetroChina) conceived of an export project to construct and operate a natural gas liquefaction facility and marine terminal in Kitmat, British Columbia, one of several LNG projects that have been proposed in the province. In a 2012 interview, Peter Voser, President of Royal Dutch Shell PLC, noted Canada had a ”narrow window” to take advantage of the lucrative global market for LNG. He added that an efficient, effective and time-bound regulatory process is vitally important from a competitive perspective.27

Voser’s analysis of a narrow window was correct. In the following months, lengthy approval processes delayed LNG Canada and other LNG proposals. As a result, the projects missed their narrow window to sign the first generation of long-term contracts with Asian utilities. While Canada watched, multiple new LNG projects in the U.S., Australia and other countries came online or started construction, providing those countries with new jobs, economic growth and government revenues.

It took LNG Canada two years, from May 2013 to May 2015, to receive approvals under the Canadian Environmental Assessment Act (CEAA). Jurisdictions that were able to move faster are now meeting high demand from Asian-Pacific countries. The price of natural gas has since declined, and LNG Canada and other projects have put final investment decisions on hold. Inefficient regulatory decision-making impeded Canada’s sector to take advantage of new economic opportunities.

If Canada can get its natural gas to new markets, it will lead to more than just economic benefits for Canadians. Exporting Canadian LNG to coal-dependent countries will have an added environmental benefit of displacing coal power and lowering global greenhouse gas emissions. Looking forward, it is speculated that the next ”narrow window” for long-term LNG export contracts could open up sometime between 2020-2025.

Crude Oil

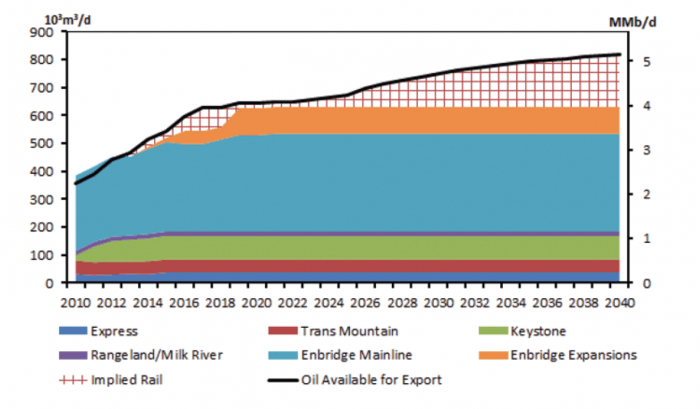

Most of Canada’s crude oil export pipelines run north-south to Canada’s largest customer. While access to the U.S. is an advantage for Canadian crude, it also means Canadian oil is captive to the U.S. market and sold at a discount relative to world prices. Canada’s pipeline infrastructure is also reaching points of constraint, particularly that which connects to the Western Canada basin. In 2012, exporters started moving crude by rail. Without new pipeline capacity, Canadian exporters will need to rely more on rail well into the future.

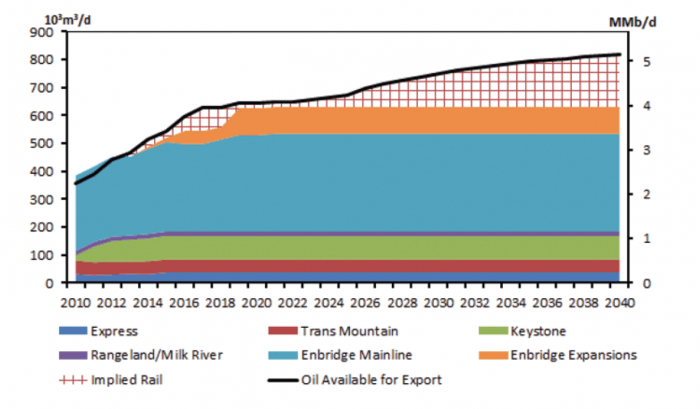

Canadian Oil Export Pipeline Capacity and Oil Exports to 2040

Source: Canada’s Energy Future 2016: Energy Supply and Demand Projections to 2040, National Energy Board

Forecasts point to the largest increases in demand for crude oil coming from emerging economies over the next 15-20 years. Canadian companies are keen to build new pipeline infrastructure eastward and westward from the Western Canada basin to tidewater so oil can be sold to non-U.S. markets at higher prices. This is reflected in the billions of dollars of new pipeline projects that have been proposed in the last decade, including Keystone XL, the Alberta Clipper Expansion, Northern Gateway, Trans Mountain Expansion and Energy East. These proposals have faced an increasing number of challenges.

Canadian and international environmental organizations have made Canada’s pipeline infrastructure the focal point of their efforts to limit the growth of Canada’s energy industry. More specifically, they have concentrated on shaping pipeline regulatory review processes and, what used to be, largely technocratic processes have become a proxy for debate about how Canada should respond to climate change. At the same time, some communities concerned about the impacts of pipelines have become more active in trying to stop pipelines from passing near their jurisdictions. This has been bolstered by the emerging concept of social licence, an undefined threshold of local support that projects must apparently meet. The challenge of social licence is not limited to oil and gas projects as many large renewable energy projects face some amount of local opposition.

Indigenous communities affected by projects have also become more active in review processes. Project proponents have faced challenges adequately fulfilling the duty to consult based on the evolving legal status of Indigenous peoples. Governments must consult Indigenous peoples and accommodate them when proposed projects could adversely affect their constitutionally protected rights. Governments often delegate the procedural aspects of this duty to business, usually by mandating project proponents to consult during the regulatory process. This can be a positive way for industry and the Indigenous communities to work together, however, the lack of a clear framework from the Crown on how to do this can undermine all parties’ interests. Often, projects that have the potential to provide long-term economic and social benefits to Indigenous communities and all Canadians are delayed or cancelled.

Governments have struggled to respond to these new realities, which has led to significant delays and uncertainty in the consideration of projects. This includes delays in the time it takes for regulators to make recommendations and delays in final decisions by governments based on those recommendations. This uncertainty makes it more difficult to attract capital to Canada as investors look to markets with less investment risk. From an environmental perspective, stalled pipeline projects means that potential customers of Canadian oil and gas (including eastern Canada) will continue to meet their needs by importing these products from countries subject to less stringent environmental controls and regulations than those in Canada.

There is still an opportunity for Canada to get this critical infrastructure built. In November 2016, 36 months after Kinder Morgan applied to the National Energy Board, the federal Cabinet approved the environmental assessment for the construction of the Trans Mountain Expansion pipeline, subject to 157 conditions. The Trans Mountain Expansion will twin an existing crude pipeline and nearly triple capacity of the line between Edmonton and Burnaby.28

The National Energy Board is also reviewing the Energy East pipeline proposal, which will use an existing natural gas pipeline with additional new infrastructure to transport oil from Alberta and Saskatchewan 4,500 km to refineries in eastern Canada and a marine terminal in New Brunswick. If built, the pipeline would reduce much of Quebec’s and Atlantic Canada’s reliance on imported oil and would allow for more overseas exports. The benefits of Energy East extend well beyond Western Canada. An independent study of the project found that it would create thousands of jobs in Quebec and Ontario, along with $6.3 billion in additional GDP activity in Quebec and $13 billion in additional GDP activity in Ontario. It is also expected to generate $2 billion in additional tax revenue for Quebec and $3.6 billion in additional tax revenue in Ontario.29

In June 2016, the federal government announced it would be reviewing federal environmental review processes, including the mandate of the National Energy Board and the Canadian Environmental Assessment Agency. This review provides an opportunity for the federal government to re-establish environmental reviews of private sector energy projects as non-political, predictable evidenced-based processes. At a time when the U.S. is preparing to reduce taxes, regulatory burden and environmental standards on the American energy industry, it is more important than ever for the federal government to create the conditions for energy projects in Canada to succeed.

Three Good Ideas…

Make federal environmental assessment processes more timely and predictable. The outcome of the reviews of the National Energy Board and the Canadian Environmental Assessment Agency will have significant impacts on the future of Canada’s energy industry. The government should increase public trust in these processes by giving them clear jurisdictional boundaries and mandates and ensuring all voices can be heard while making science and evidenced-based decisions in a reasonable set amount of time.

The federal government should be a champion of regulatory outcomes. The federal government must defend the outcomes of Canada’s environmental reviews to help build and maintain public and investor confidence in those reviews. This is especially important as there are some organizations and individuals who seek to undermine public trust in Canada’s environmental review processes.

Provide greater clarity to business and Indigenous peoples regarding the duty to consult. Problems will continue to arise as long as there is a lack of clarity around when, how and to what degree the federal government can delegate its duty to consult with Indigenous communities. The federal government should lead the development of a consistent consultation framework so that governments, business and Indigenous peoples all know what is expected of them in fulfilling their respective duties.

GREEN ELECTRIFICATION AND TRANSMISSION

The problem:

Without improved electrical grid connectivity between provinces, it will be more difficult to meet Canada’s climate change commitments.

Although Canada has one of the cleanest electricity systems in the world, with 80% of production from nonemitting sources, electricity generation is still Canada’s fourth-largest source of greenhouse gas (GHG) emissions.30

Generation and transmission primarily falls under provincial jurisdiction in Canada, save for federal responsibilities related to interprovincial and international transmission and environmental protection. Although the sector is divided among provincial and territorial lines, Ottawa’s involvement in electricity issues has been expanding as the federal government has strengthened national efforts to reduce Canada’s GHG emissions. These efforts have been supported through renewed engagement with the provinces and territories on a climate change agenda. This federal-provincial cooperation led to the March 2016 Vancouver Declaration in which First Ministers agreed to implement GHG mitigation policies to meet or exceed Canada’s 2030 target of a 30% reduction below 2005 levels of emissions, including specific provincial and territorial targets and objectives.

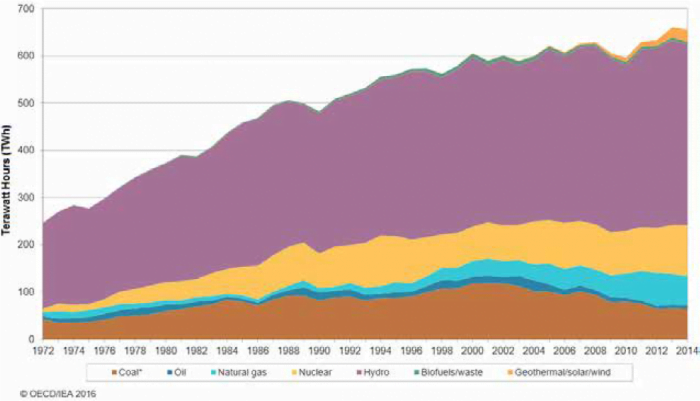

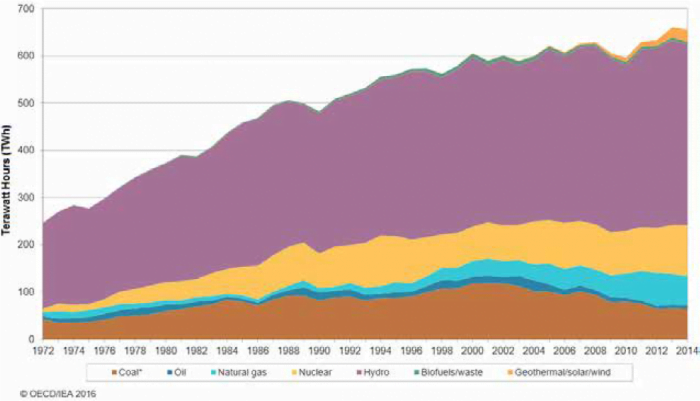

Electricity Generation in Canada, 1972-2014

To help meet these targets, the federal government has announced regulations under the Canadian Environmental Protection Act to accelerate the phase-out of coal-fired electrical generation. Under the plan, existing federal regulations to phase-out coal power plants will be brought forward to 2030, affecting the four provinces still relying on coal: Alberta, Saskatchewan, Nova Scotia and New Brunswick. While the accelerated phase-out will contribute to Canada’s climate goals, replacing a low-cost source of energy in these provinces will increase electricity costs for Canadians and Canadian companies.

New Brunswick has one remaining coal-generating station that the government is considering converting to natural gas or biofuel. Nova Scotia has signed an equivalency agreement with the federal government that will allow the province to keep using coal electricity provided it finds equivalent reductions in other areas of its electricity sector. Nova Scotia also intends to import hydro electricity from Newfoundland and Labrador’s massive Muskrat Falls hydroelectric project through the Maritime Link, a new high-voltage transmission line being constructed between Newfoundland and Nova Scotia that includes 170 km in subsea cables.

Ontario’s experience phasing out coal illustrates the challenge facing Alberta and Saskatchewan. In 2003, Ontario committed to phase-out coal by 2007. In 2005, the target was pushed back to 2009, and in 2007, the date was further extended to the end of 2014, which Ontario successfully met.31 However, the starting point for Ontario in 2003 was much different than what it is today for Alberta and Saskatchewan. In 2003, coal accounted for 25% of Ontario’s power supply, with a baseload of 63% of power from hydro and nuclear sources. By 2015, following the phase-out of coal, hydro and nuclear accounted for 81% of the province’s generation. Alberta and Saskatchewan currently generate 51% and 42% of their electricity from conventional coal. Neither has nuclear, and at present, hydro is only a small part of the mix in both provinces (2% and 14% respectively).32 33

Even with its significant hydro and nuclear generation, the transition to cleaner energy in Ontario has not been without cost. Procurement decisions to increase the non-hydro renewable composition of its grid (from 1% in 2003 to 9% in 2015) is one factor that has contributed to significant electricity rate increases in the province, imposing higher costs on consumers and businesses.

Electricity Generation by Fuel Share

| Fuel |

Ontario

(2003) |

Ontario

(2015) |

Alberta

(2015) |

Saskatchewan

(2015) |

| Coal |

29% |

0% |

51% |

42% |

| Natural Gas |

8% |

10% |

39% |

34% |

| Hydro |

24% |

23% |

2% |

14% |

| Wind, Biomass, Solar and Others |

1% |

9% |

8% |

6%* |

| Coal with Carbon Capture Storage |

0% |

0% |

0% |

4% |

| Nuclear |

39% |

58% |

0% |

0% |

| Total |

100% |

100% |

100% |

100% |

* includes imports

Sources Albert Energy, SaskPower, Ontario Energy Board

Canada: A Nuclear Leader

In 2015, Canada was the sixth-largest producer of nuclear electricity in the world through four active nuclear facilities: three in Ontario and one in New Brunswick. All four facilities use Canadian-developed CANDU nuclear technology. In addition to developing and exporting CANDU technology, Canada is the world’s second largest producer of uranium and possesses the world’s largest deposits of high-grade uranium.*

In Ontario, nuclear accounts for nearly 60% of electricity generated. Ontario Power Generation (OPG) has started an ten-year refurbishment of the Darlington Nuclear Generating Station, the second-largest nuclear facility in the country and responsible for 20% of Ontario’s generation. The refurbishment is the largest clean energy project in the country, will take until 2026 to complete and will keep Darlington operational until 2055.

Despite Canada’s nuclear success, there is no serious momentum for nuclear generation to help replace coal in Alberta and Saskatchewan. In 2008, Bruce Power applied for a permit to build a reactor 480 km northwest of Edmonton. Plans were abandoned in 2011 due to a lack of support in the region. SaskPower, the provincial electric utility, has continued to study the feasibility of nuclear power in Saskatchewan but has no plans to proceed with a nuclear facility anytime soon. Realistically, the length of time needed to gain a reasonable level of social acceptance, plan, build and licence a nuclear facility makes it an unlikely source of power in either of the two provinces by 2030.

*Natural Resources Canada, Uranium in Canada, www.nrcan.gc.ca/energy/uranium-nuclear/7695

Alberta and Saskatchewan are both planning significant investments in new renewable energy capacity, including wind and solar. Even with adding new renewable capacity to their grids, both provinces will still require a significant natural gas baseload to replace coal. A recent analysis by the Canada West Foundation, Power Up: The Hydro Option, suggests that for Alberta and Saskatchewan, interprovincial hydro imports from British Columbia and Manitoba may be best way to bring clean, reliable power onto their grids by 2030.34 The study argues that importing hydro through improved provincial grid connectivity may be a more cost-and time-effective than other options available. Canada already has strong connectivity with the U.S., with more than 30 major transmission to U.S. states facilitating net exports of approximately 9% of Canada’s electricity.35 East-west connectivity is much more limited, preventing significant electricity trade between provinces.

Federal climate change policies can also encourage more interprovincial green energy collaboration. Under the Pan-Canadian Framework on Clean Growth and Climate Change, provinces do not receive any credits to their GHG targets for exporting clean energy to one another and helping other provinces lower their emissions. Under the Framework, it makes no difference to Manitoba’s GHG reduction targets if the province exports hydro to the U.S. or to Saskatchewan. However, selling to Saskatchewan will displace coal and natural gas generation, lowering Canada’s overall emissions. If the Pan-Canadian Framework credited Manitoba’s targets with some of those reductions, it could help incentivize hydro-producing provinces to connect and export that energy within Canada rather than to the U.S. In the absence of a more national approach to green electrification and transmission, provinces will replace most coal power with another fossil fuel, natural gas, over available green options.

Recent federal-provincial climate cooperation and new federal infrastructure commitments could lead to new interprovincial transmission investment. In 2016, the federal government expressed support for connectivity between Canada’s balkanized electricity markets on multiple occasions. The 2016 federal budget committed $2.5 million over two years to “…facilitate regional dialogues and studies that identify the most promising electricity infrastructure projects with the potential to achieve significant greenhouse gas reductions…” The 2016 fall economic statement noted that eligible projects for the $22 billion federal green infrastructure fund include “…interprovincial transmission lines that reduce reliance on coal-fired power generation…”36 When announcing the accelerated coal phase-out, the Minister of the Environment stated the government will support the transition away from coal “…by using the Canada Infrastructure Bank to finance projects, such as commercially viable clean energy and modern electricity systems between provinces and territories.” Finally, in the December 2016 Pan-Canadian Framework on Clean Growth and Climate Change, federal and provincial governments agreed to “…work together to help build new and enhanced transmission lines between and within provinces and territories.”

Wataynikaneyap Transmission Project

There are 25 communities in Ontario that are not connected to the province’s electrical grid. The Wataynikaneyap Transmission Project proposes to connect 17 of these communities, home to 10,000 Ontarians, to the province’s transmission system. The project is 51% owned by a partnership of 22 First Nations with the remaining share owned by FortisOntario. The estimated capital cost of the project is $1.35 billion, and based on diesel rates, it is expected the project will break even in two decades. The project will also allow future renewable energy projects in the region to connect to the provincial grid and sell power. The project is currently seeking a federal and provincial funding arrangement and hopes to start construction in 2018 with an initial phase completed by 2020 and a second phase completed by 2024.

The new federal interest in financing interprovincial transmission infrastructure will be confronted with the current challenges of building energy infrastructure in Canada. Large-scale private sector and utility collaboration in clean energy generation and transmission projects would be bolstered by ensuring their regulatory processes are transparent and efficient.

Efforts to lower emissions from Canada’s electricity system must also include bringing cleaner energy to the 292 rural and remote off grid-communities, most of which are powered by diesel generation. Although diesel generation is a relatively small source of Canada’s overall GHG emissions, it is an expensive fuel source and is harmful to local environments. Advancements in renewable energy, micro grids and energy storage are creating new sustainable electricity options for communities currently dependent on diesel generation to meet their energy needs. Many of these communities will require help with the up-front capital costs to transition to cleaner energy sources.

Three Good Ideas…

Support interprovincial grid connectivity where it makes sense. The federal government has signaled that it wants to support investments in interprovincial transmission infrastructure. Any new public investment should take into account the differences between provincial energy markets and limit harm to private investors in deregulated, open markets. The Pan-Canadian Framework on Clean Growth and Climate Change can further enhance regional electricity collaboration by incentivizing provinces to export green energy to other provinces.

Ensure the shift to more renewable electricity protects consumers, businesses and overall reliability. The costs of moving away from cheaper and higher polluting sources of energy will be borne by Canadians and Canadian companies. Government decision-making should weigh how these costs will impact Canadian competitiveness and consider ways to lower other government-imposed costs of doing business in Canada. Adding more renewable power should also be phased in in a way that does not endanger grid reliability.