Today, the Ontario Chamber of Commerce (OCC) released the report, Breaking Barriers: Ontario’s Scale Up Challenge, which identifies the major roadblocks preventing Ontario businesses from expanding and presents recommendations to best support business owners in taking their ventures to the next stage of growth. According to the report, based on interviews with nearly two dozen business owners, sector associations, and other organizations, as well as a survey of over 350 Ontario business owners, too few entrepreneurs are continuing to build their business, or “scale up”, in the province.

The report adds to a recent chorus of voices calling for governments, the business community, and other actors to build on the province’s entrepreneurial spirit by creating the conditions to enable our most promising firms to scale. Read more below.

BREAKING BARRIERS:

BREAKING BARRIERS:

Ontario’s Scale Up Challenge

CONTENTS

A Letter from the President and CEO

Summary of Recommendations

Introduction

What is “scaling up”?

How do we compare?

What are the benefits of scaling up?

What are the barriers to scaling up in Ontario and across Canada?

Recommendations

Conclusion

Works Cited

A LETTER FROM THE PRESIDENT AND CEO

In the 21st century economy, Ontario’s continued growth and prosperity depends on our capacity to innovate and translate these new ideas into real economic gains. To do so, we need to create an environment that lets our most promising firms thrive.

To spur the creation of new and innovative companies, governments, institutions, and the business community have done much to build up and tap into the entrepreneurial spirit of Ontarians. However, too few entrepreneurs are continuing to build their business, or “scale up”, in Ontario. As such, the province is foregoing many of the economic benefits that could be provided by this untapped growth potential.

This report explores the issue of scaling up in the Ontario context. As the report reveals, businesses in the province are facing a number of barriers that are preventing them from “scaling up” in Ontario. These include a labour pool that lacks scaling experience, insufficient access to financing, and misaligned public supports and incentives. The recommendations contained in this report are designed to break down these barriers and enable the province’s businesses to attain their full growth potential.

Our recommendations are also designed to inform, complement, and build on efforts begun by the governments of Canada and Ontario to tackle the scaling up challenge. The federal government is moving ahead with the development of an innovation agenda that will redesign how it supports business growth, as well as an initiative to help high-impact firms scale up. At the same time, the provincial government is moving ahead with a set of initiatives to help Ontario businesses scale up, one of the three pillars of its Business Growth Initiative.

From the perspective of Ontario’s business community, these are encouraging and necessary steps in order for Ontario to continue to compete on the global stage. We urge the federal and provincial governments to engage with the business community and other organizations throughout the development of their initiatives. Considerable work has already been done by a number of organizations—many of which are referenced in this report—to understand this challenge. To be most successful, it is imperative that new initiatives build on these efforts.

We have an incredible opportunity to leverage the alignment of provincial and federal policy, as well as the business community, to tackle this challenge. Let us take full advantage of it.

Sincerely,

Allan O’Dette, President & CEO,

Ontario Chamber of Commerce

SUMMARY OF RECOMMENDATIONS

The Ontario Chamber of Commerce urges the Government of Ontario to:

- Improve access to talent by working with the federal government to create a scale-up visa to accelerate

access to qualifi ed international candidates - Improve access to fi nancing by fi rst gaining a better understanding of existing gaps

- Ensure public programs and incentives are aligned to encourage businesses to scale up by:

- Focusing supports on high-growth firms and those with high-growth potential

- Delaying taxation on corporate income growth

- Encourage greater international trade activity by:

- Increasing support for businesses seeking to engage in international trade

- Linking more business support programs to international trade

- Improve access to anchor customers by:

- Leveraging public procurement to strategically invest in growing businesses

- As a business community, viewing partnerships with Ontario’s small and growing firms as

competitive business development opportunities

- Enable accurate measurement of the scale up challenge and monitoring of public policy responses by working with Statistics Canada and industry groups to collect and publicize relevant data

INTRODUCTION

Canada’s governments, educational institutions, and other actors are making a concerted effort to boost entrepreneurship and create new and innovative businesses. Among the objectives of this effort has been to enable sustainable and long-term economic growth.

In some ways, the results of this effort has been successful: Canadians now create new firms at a higher per capita

rate than Americans, partly a result of the rapid growth of the start-up ecosystem.1,2 As such, Canada currently ranks as a global leader in entrepreneurship, particularly for early stage projects.3,4

Despite these encouraging results, the expected economic rewards of business creation have not been realized. While Canadians may have greater opportunities to start a business, the next generation of large and globally competitive Canadian firms has not materialized. Among business leaders, there is a growing consensus that the nation faces a critical gap in its business growth strategy: businesses are not “scaling up” into large, world-leading organizations.

In this report, the Ontario Chamber of Commerce explores the issue of “scaling up”. Our objective is to answer the following question: “How can government, the business community, and other actors encourage more firms to scale up in Ontario?”

To answer this question, our report builds on the substantive work of the Centre for Digital Entrepreneurship and Innovation (DEEP Centre), the Institute for Competitiveness and Prosperity (ICP), and other organizations. The OCC’s findings are based on extensive interviews with Ontario businesses, sector organizations, members of the start-up ecosystem, research organizations, as well as government. To further situate the report in an Ontario context, we also conducted a province-wide survey of over 350 business owners to investigate the barriers to growth. Moreover, our report builds on encouraging steps currently being taken by the governments of Ontario and Canada to address this issue.

Our report is divided into four sections. First, we define the concept of “scaling up” and outline its economic benefits. Second, we explore how Canada compares to other jurisdictions. Third, we discuss the barriers Ontario businesses face when scaling. Finally, we provide recommendations to the provincial and federal governments, and the broader business community, to inform and complement steps existing initiatives.

While the OCC’s mandate is focused on Ontario, a lack of Ontario-specific data has made it difficult to conduct a provincial-level investigation in this report. As such, most discussions in the report pertain to the Canadian context. Where possible, we inject Ontario-specific data into the conversation.

In writing this report, we hope to identify the foundations required for Ontario to build an innovation-driven economy that enables sustainable, long-term economic growth.

WHAT IS “SCALING UP”?

Before discussing the economic implications of and barriers to scaling up, it is important to understand what it means to “scale up”.

In this report, the OCC adopts the Organization for Economic Co-operation and Development’s (OECD’s) definition of a “high-growth firm”. According to this definition, a firm is “scaling up” if it is experiencing average annualized growth rates in employment or revenue greater than 20 percent per year, over a three-year period, and if it had 10 or more employees at the beginning of the period. Put simply, firms are scaling up if they are experiencing sustained periods of rapid growth.a

HOW DO WE COMPARE?

According to the Global Entrepreneurship Monitor, Canada is a leader in early stage entrepreneurial activityb, scoring above many G7 nations and almost equal to U.S.5 Similarly, Ontario has above average early stage entrepreneurial activity among innovation-driven economies, and ranks among the highest in terms of opportunity-motivated entrepreneurship.6

Unfortunately, this entrepreneurial activity has not resulted in expected economic outcomes, namely the growth and proliferation of new and innovative firms. According to the DEEP Centre, “Canada continues to struggle to produce the type of sustainable, high-growth firms in knowledge-intensive sectors that policy-makers have identified as crucial to the country’s economic future”.7

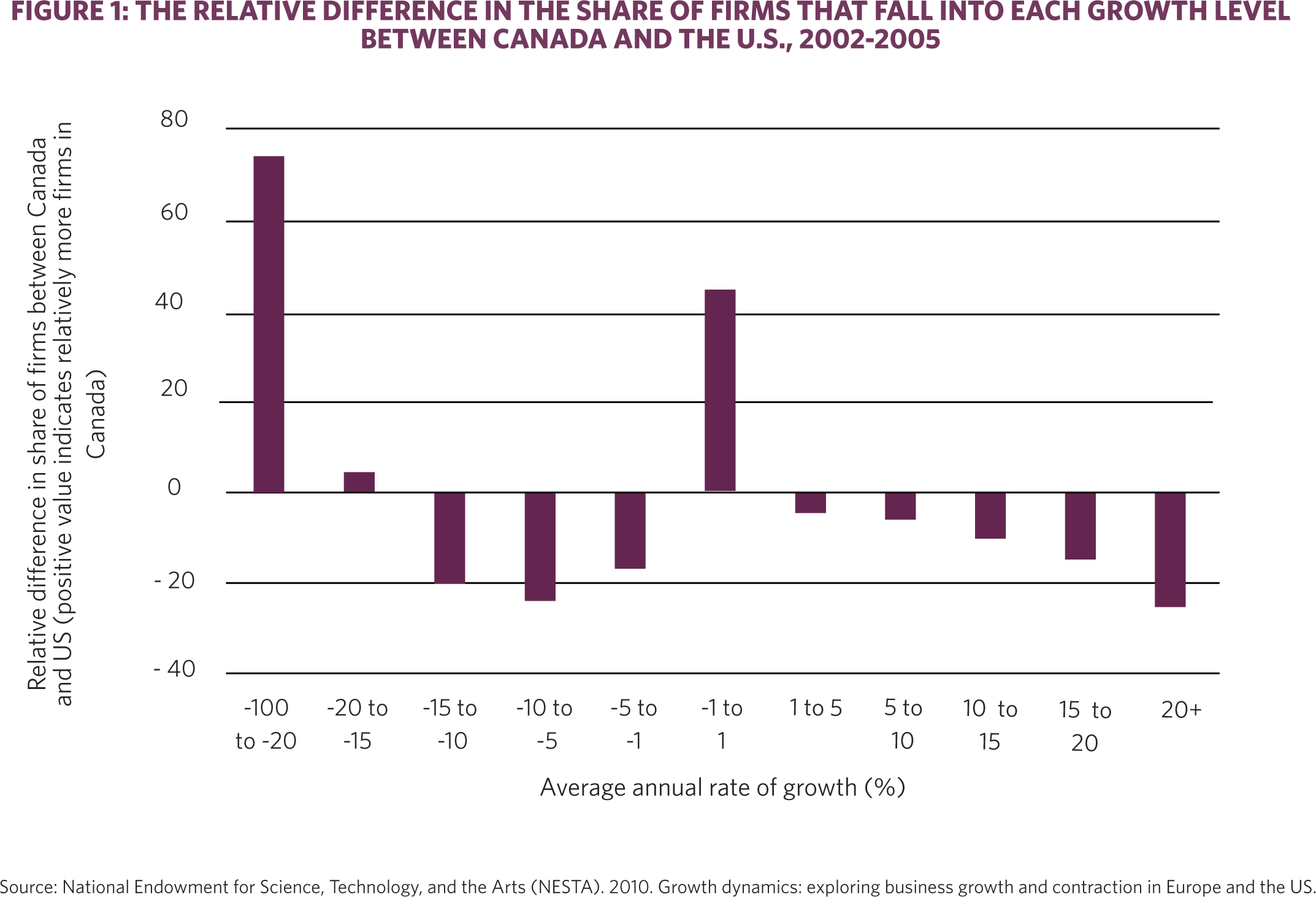

In terms of overall business creation, Canadians create firms at a higher per capita rate than Americans.8 However, evidence suggests that Canada is failing to scale up its firms at comparable levels to other nations. For example, compared with the U.S., Canada is experiencing a clear scale up gap.9,10 This is revealed in Figure 1, which displays the share of firms that fall within each growth interval in Canada compared to the U.S. As illustrated, American firms are more likely to experience rapid growth, while Canadian firms are more likely to experience little growth or rapid decline.

As a result, Canada’s small firms contribute relatively more to total economic output compared to the U.S. 11

In addition, Canada’s billion-dollar firms contribute a much lower share of total revenues compared to other economies.12 Despite the proliferation of start-up accelerator organizations (SAOs) in Canada, there has been limited success in creating large firms relative to our American counterparts.13

Canada’s failure to scale its companies is a critical gap in our nation’s business growth strategy. A focus on entrepreneurship to inject new and innovative ideas into the economy is important, but Canada foregoes the long-term economic benefits of this activity if its most promising businesses are unable to grow. This challenge is consistent with the reality in Ontario.

This is why the governments of Canada and Ontario are moving forward with strategies to encourage more companies to scale up. The federal government recently announced a new initiative to help 1,000 high-impact firms access a coordinated suite of services specific to their growth needs. This is in addition to other initiatives that increase support for growth-oriented small and medium-sized firms.

In Ontario, the government is implementing a voucher program to provide growth-oriented firms access to specific services that align with their growth needs. The province is also piloting a project to boost government’s role as an adopter of Ontario-based innovation, and creating a centralized office to ease access to business support programs.

Why are governments moving rapidly to address this issue? In the next section, we outline the economic benefits of encouraging more firms to scale up.

a This approach is consistent with Innovation, Science and Economic Development Canada and other research organizations engaging with this topic (see, for example, Coutu 2014).

b A combined measure of the nascent entrepreneurship rate and new business ownership rate.

WHAT ARE THE BENEFITS OF SCALING UP?

High-growth firms are responsible for a large proportion of economic growth and job creation

In Canada, small- and medium-sized enterprises (SMEs), or businesses that employ less than 500 individuals, form a large component of the overall economy. Over the past ten years, for example, 71 percent of the jobs created in the private sector can be attributed to the activities of SMEs.14

However, recent research reveals that most of these gains are due to the growth of a much smaller group of firms. From 2000 to 2009, high-growth firms made up only 18 percent of Canada’s growing firms but created nearly 47 percent of new jobs.15 This supports earlier research by Industry Canada revealing that Canada’s fastest growing firms were responsible for 45 percent of net job creation, despite comprising only four percent of businesses.16 Research in other jurisdictions reveals similar findings.17,18,19,20

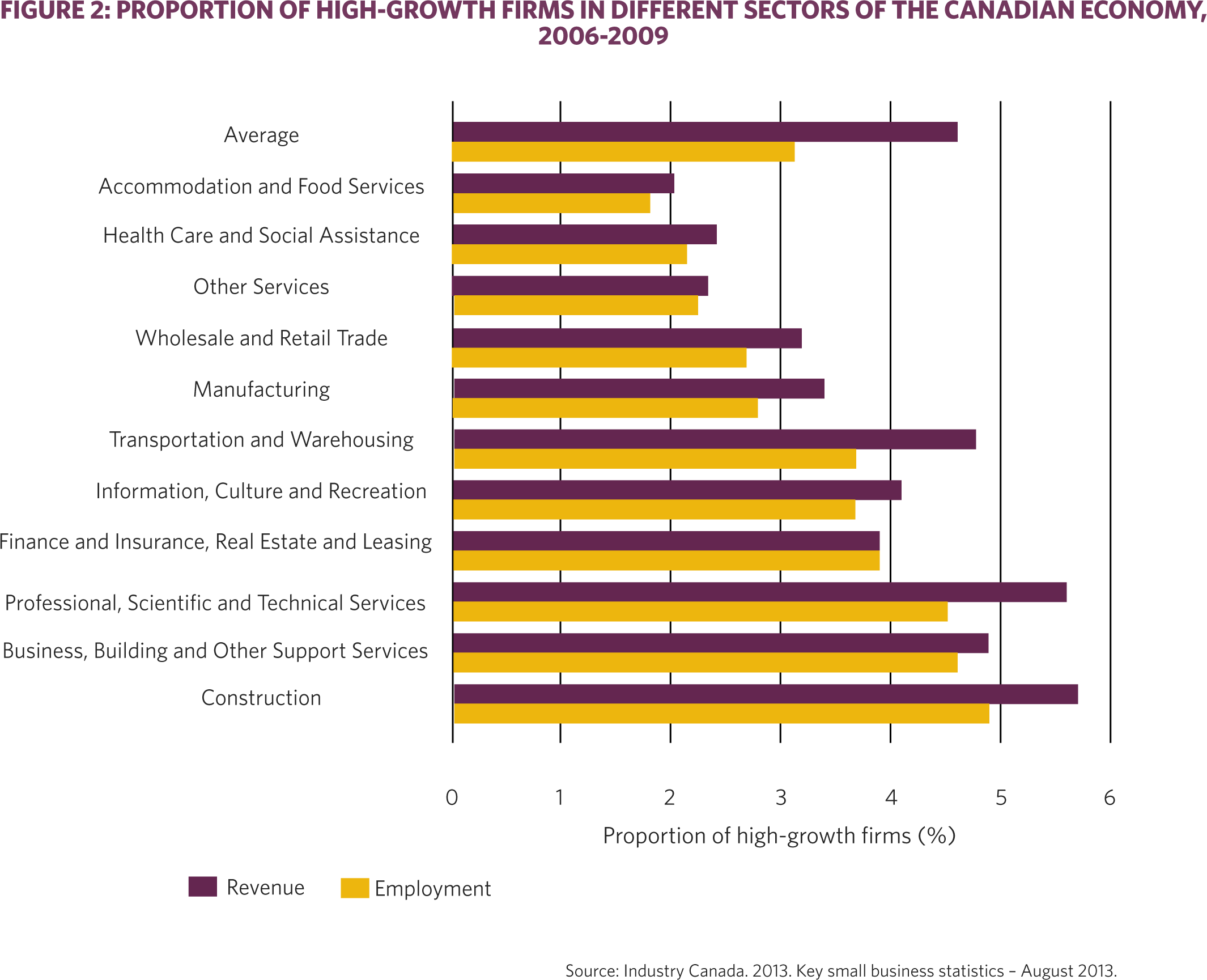

Importantly, the population of high-growth firms in Canada is diverse. As shown in Figure 2, high-growth firms can be found in all sectors of the economy. Consistent with findings in other jurisdictions, these firms can be found in all size and age categories.21,22,23,24

Large firms also create disproportionate economic benefits

An important result of encouraging more firms to scale up is potentially increasing the number of firms that

reach a larger size. This is because large firms tend to contribute a disproportionately greater amount to overall

economic activity.

In Canada, large companies (companies that employ 500 or more people) account for less than one percent of all businesses, but produce nearly 46 percent of total Gross Domestic Product (GDP).25 While large firms do employ a significant proportion of Canadian workers (36 percent), employees at these firms are also more productive; indeed, the level of productivity of small firms is less than half of productivity of large firms.26,27 In many cases, this is because large firms are able to take advantage of economies of scale – as size increases, the cost per output decreases. 28

Large firms in Canada also engage disproportionately more in other economically important activities. For example, they are more likely to conduct research and development (R&D): only one percent of small firms conduct R&D, compared to 15 percent of larger firms.29,30 In addition, large firms are also more likely to export, and generate significantly more of the total value of exporting than smaller firms.31,32

In this section, we outlined the economic benefits of scaling up. As shown, both firms in the process of scaling up and firms who have scaled disproportionately contribute to economic activity. This means that the economic potential of encouraging more firms to scale could be substantial.

That said, Canada and Ontario are lagging behind. The next section of this report outlines some of the reasons why this is the case.

WHAT ARE THE BARRIERS TO SCALING UP IN ONTARIO AND ACROSS CANADA?

Businesses in Ontario and across Canada are failing to scale up. As such, we are missing out on the economic benefits associated with scaling. This begs the question: what can be done to scale up more of our companies? To answer this question, we must first identify the specific barriers preventing businesses from scaling up.

To identify these barriers, the OCC has built on the work of other organizations through extensive interviews with Ontario businesses, sector organizations, members of the start-up ecosystem, research organizations, as well as government. The OCC also undertook a survey of over 350 members of Ontario’s business community to investigate the barriers facing businesses looking to grow in the province. In the absence of readily available Ontario-specific data, we hope that this survey provides valuable insight into the discussion. The results of this collective research effort point to a number of different barriers inhibiting businesses from scaling up in Ontario and across Canada.

According to our surveyc, the cost of doing business is the top barrier to growth facing businesses with growth intentions in the province. This is a subject that the OCC has discussed extensively through work related to the electricity prices, the Ontario Retirement Pension Plan, and other policy issues. For the purposes of this report, we have decided to focus on those issues that are more uniquely related to the scaling up conversation.

Professionals with the right skill set to help businesses scale up are too scarce

In our survey, nearly two-thirds of respondents with growth intentions identified access to talent as a barrier to growth; 21 percent of respondents said this factor was a top barrier. Aside from the cost of doing business, access to talent was the most commonly cited barrier to growth. One-quarter of businesses without growth intentions cited access to talent as a growth barrier.

In Canada, evidence suggests that individuals with the requisite skills to help companies scale up are scarce. In a 2014 report, the DEEP Centre found that the biggest challenges facing fast-growing small firms in Canada are related to talent and management. Specifically, these firms are inhibited by a lack of management talent with “experience implementing ‘go-to-market’ strategies”.33 These findings were echoed by a survey of Canada’s high-impact firms, who often cite the recruitment of specialized labour as a key challenge in Canada.34

Most recently, a lack of management talent was identified as the top constraint to growth by Canadian technology stakeholders.35 A key finding of the Lazaridis Institute, and echoed by the OCC’s stakeholder research, is that the Canadian management talent pool lacks expertise in sales, marketing, and organizational design.36

As a result, many companies attempting to scale in Canada today must look abroad to fulfill their talent needs. For these companies, Canada’s immigration system appears to present an additional barrier. The OCC heard that an overly-bureaucratic application process, lengthy processing times, and the risk of being rejected act as deterrents for companies looking to hire internationally.

While looking abroad may be a short-term solution to the talent problem, it is an essential one. If part of the issue is self-reinforcing (i.e. there is a lack of experienced people because not enough companies have scaled), then bringing in the right international talent to allow more companies to scale will help to train the next generation of experienced managers in Canada.

Businesses may not have sufficient access to some forms of financing

Access to capital or financing is commonly cited as a scaling up challenge. However, it is unclear how significant this challenge is for most firms. As the discussion below reveals, financing is generally available to Canadian firms, but may be in shorter supply for certain firms seeking certain types of financing.

In Statistics Canada’s 2014 Survey on Financing and Growth of SMEs, 67 percent of businesses indicated that obtaining financing was not an obstacle to their growth, the highest of any category. Only 9 percent of businesses cited obtaining financing as a major obstacle to growth. This may be because the majority of SMEs seek access to traditional financing, which many businesses agree is readily available in Canada.37

That said, results from our Ontario-specific survey of businesses suggests that access to financing may be a bigger issue locally than nationally, at least for businesses looking to grow. For example, 15 percent of respondents with growth intentions indicated that access to financing was their top barrier to growth, and 47 percent cited this issue as a barrier.

It is possible that not enough financial capital is flowing to the fastest growing firms, an issue also identified in other jurisdictions.38 In this respect, high-growth SMEs appear more challenged than average SMEs in Canada. According to the 2014 Survey on Financing and Growth of SMEs, while high-growth SMEs are more likely to request financing, they are slightly less likely to have their request approved.

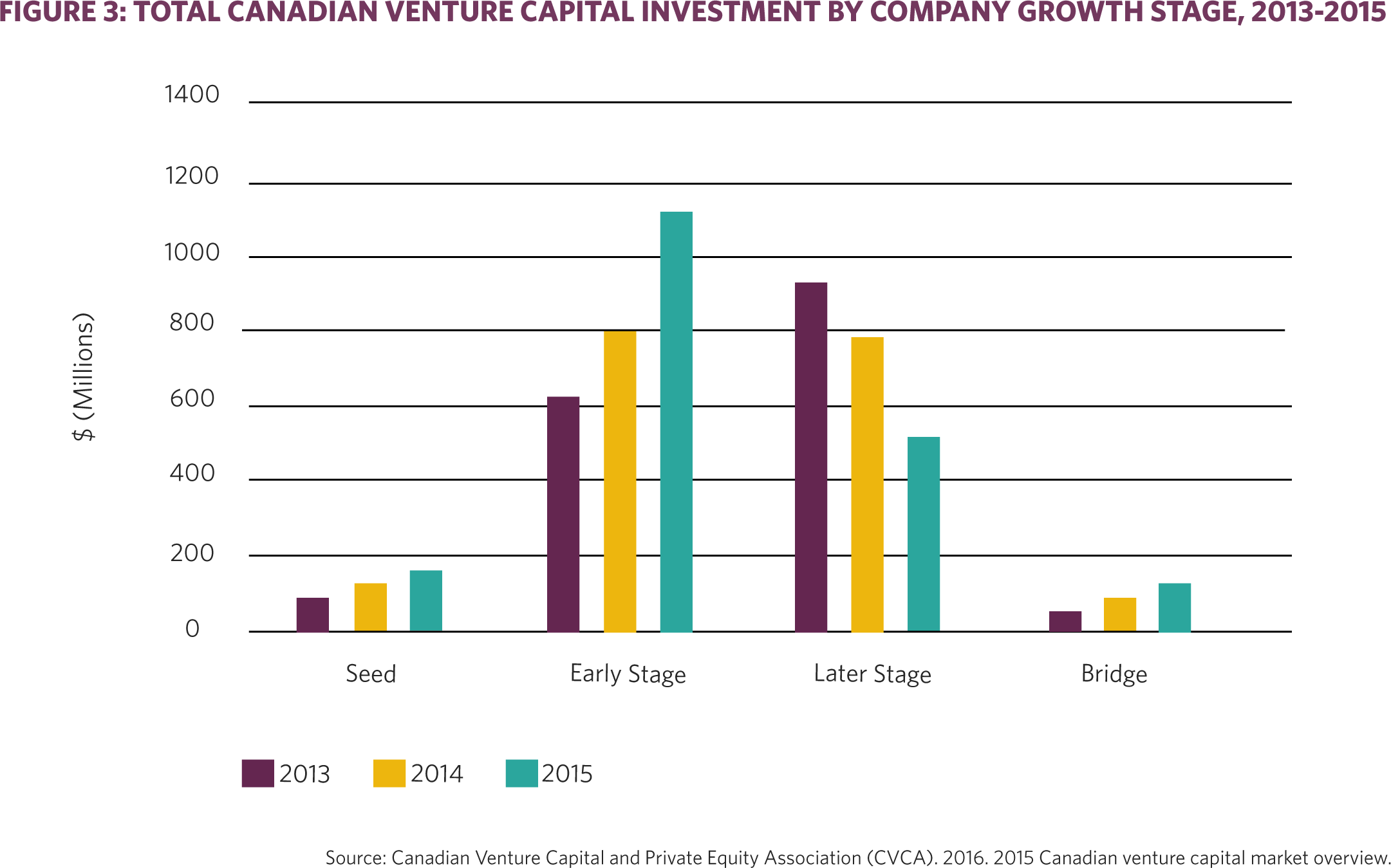

This increased difficulty in obtaining financing for high-growth firms may, in part, lead to their greater propensity to seek out equity and other alternative sources of higher-risk. These sources of financing are important for firms that may be growing too fast or have business models that are too unfamiliar to traditional financing providers.39 According to a recent BDC survey of mid-sized high-growth firms, accessing higher risk financing can be difficult; indeed, Canadian businesses cite higher risk financing challenges twice as often as American companies.40 In addition, while total venture capital investment (a key component of equity financing) in Canada has increased substantially over the past few years, investment in later-stage companies had declined by nearly half (Figure 3). 41

In our consultations, the OCC heard mixed perspectives on whether access to higher-risk financing is a considerable concern for most high-growth businesses. For earlier stage companies, particularly in the tech sector, we heard that this was a significant challenge. However, others suggested that financing challenges were simply a consequence of market decisions: money will flow to the best companies.

Public business supports and incentives are not aligned with scaling up objectives

The federal government and the Government of Ontario provide many business support programs to foster economic growth and development. In our survey, over 50 percent of respondents with growth intentions indicated that they had sought out government resources.

A closer look at the suite of programs available to businesses in Ontario suggests that scaling up has not been a key priority of the province’s business growth strategy. According to ICP, the Government of Ontario currently offers 127 programs to support business growth in the province, yet they are not necessarily oriented towards factors that actually influence growth.42 In addition, these programs are distributed across a wide range of sectors and business types, and can be duplicative and uncoordinated.43,44 Others noted that eligibility criteria for existing programs, such as minimum years operating or size of workforce, might unnecessarily restrict businesses’ access to public supports. Encouraging more firms to scale up requires reassessing how public programs align toward this objective.

Another important vehicle through which government interacts with the business community is the tax system. In Canada, federal and provincial governments offer numerous tax credits and different levels of taxation to act as incentives or disincentives for certain types of behaviour. Again, a closer look at the tax system suggests scaling up has not been a key priority.

For example, the small business deduction (SBD) allows small firms to pay a lower corporate tax rate than large firms.45 In Ontario, the tax rate is reduced from 11.5 percent to 4.5 percent for the first $500,000 of a firm’s annual earnings before income tax and phases out based on the value of a firm’s assets. The rationale for providing tax preferences to smaller firms is to improve economic performance by mitigating the impact of market failures associated with a reduced access to capital.46,47

While the SBD is intended to encourage small business growth, research suggests that the deduction may inhibit growth above a certain size: Canadian firms tend to cluster at the $500,000 threshold and within the qualifying asset range.48 While the clustering effect may be less pronounced than expected, the SBD may carry a higher social cost compared to alternative tax structures.49

Perhaps a more fundamental issue is that major tax incentives do not specifically target growing firms.50 For example, the qualifying variable for the SBD and other tax incentives, like the Scientific Research and Experimental Development (SR&ED) credit, is firm size.51 However, as described earlier, the only characteristic that high-growth firms share in Canada is their rapid rate of growth; firms that are scaling up are not of a particular size or age, nor are they clustered in a particular sector.

Businesses are not sufficiently engaged in international trade

In the Canadian context, accessing new customers via international markets is an essential component of business growth. Due to the country’s relatively small market, most companies looking to scale their business must go elsewhere for new customers. This is exacerbated by the presence of interprovincial trade barriers, including inconsistent regulations related to labour, pensions, and securities that fragment our already small market. According to the OCC’s survey, only 15 percent of businesses with growth intentions identified access to new markets as a barrier to growth. However, this may be because only 19 percent of businesses surveyed currently export to other markets.

For Canadian firms, the benefits of international trade in terms of growth are clear. In a recent investigation of the drivers of firm growth in Ontario, ICP found that engagement in international trade exhibits a large return in both revenue per employee and employment size.52 As a result, exporters disproportionately contribute to the Canadian economy. Between 1993 and 2002, for example, exporters accounted for less than six percent of firms but created 47 percent of jobs.53

Data from the 2014 Survey on Financing and Growth of SMEs suggests that a small proportion of Canadian firms engage in trading activity. For example, less than 12 percent of Canada’s SMEs exported; this proportion was slightly greater in Ontario at nearly 15 percent. This is much lower than many European nations.54

According to Industry Canada, this discrepancy can at least partially be explained by geography.55 Unlike their European counterparts, Canadian firms are not members of a large economic union and do not benefit from close proximity to a number of different nations. When compared to other geographically isolated countries like the U.S. or Australia, Canadian SME exports are equivalent and sometimes greater.56

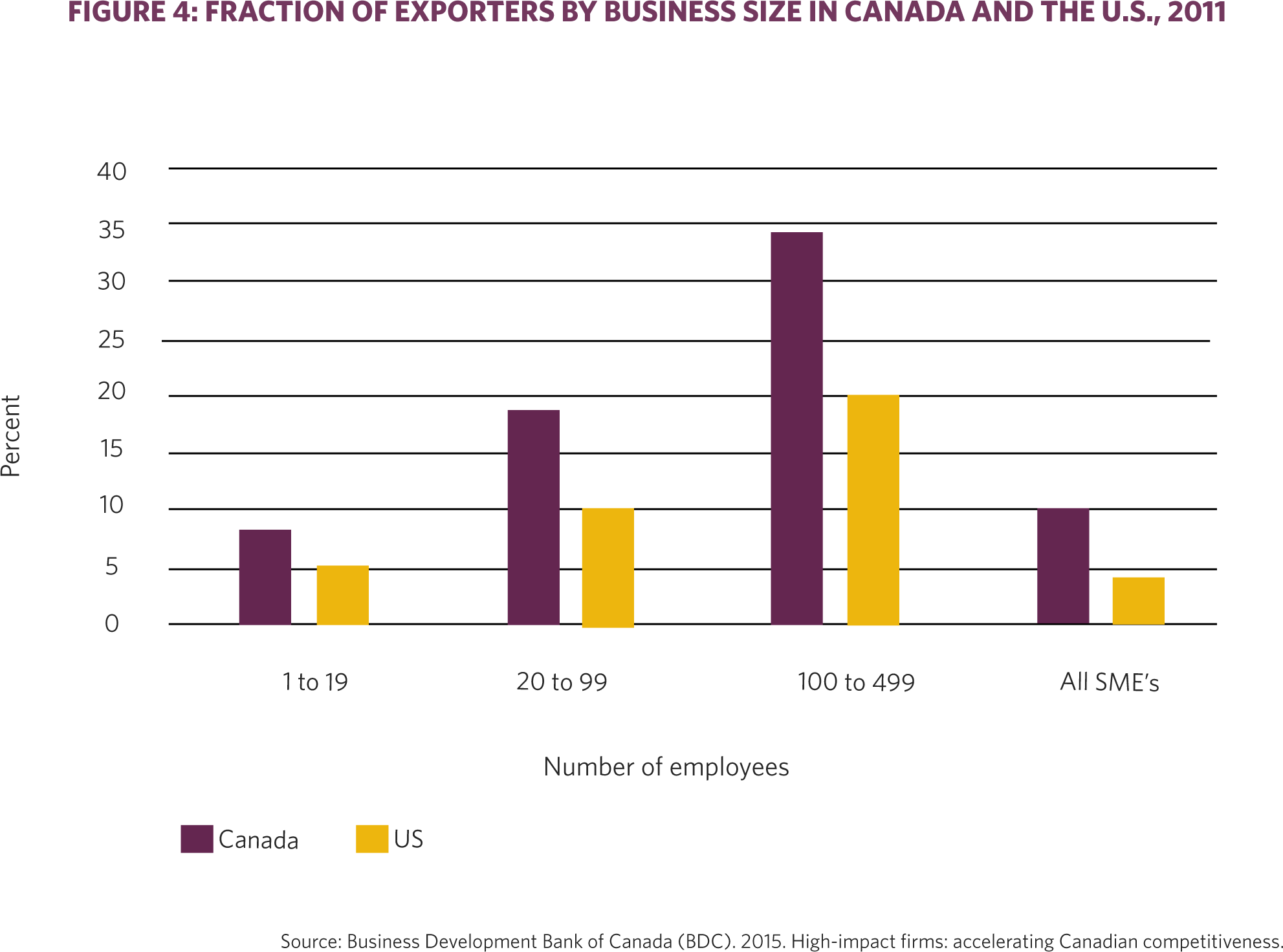

Internal business demands related to exporting may also be a barrier. Exporting is a complicated activity that requires a different set of skills and resources than operating and competing domestically. At the same time, it exposes businesses to a different set of risks, including currency fluctuations, new business relationships, and greater competition.57 Compounding these risks is Canada’s small market, which requires business leaders to take on these challenges at a much earlier stage in their business’s growth plan.58 In Canada, small firms are more likely to prioritize international growth early, particularly when compared to American businesses.59 With a larger domestic market, American SMEs of a given size are much less likely to be exporters than Canadian SMEs (Figure 4).60

Facing these challenges requires a level of commitment and expertise that might be an obstacle for some firms. This partly reinforces the need for businesses to have employees with the right skill set, as discussed earlier.

To reduce the barriers to exporting, the federal and provincial governments offer various support programs. At the federal level, the government provides direct funding programs to encourage international trade, such as the recently announced $50 million CanExport program to help SMEs seeking new export opportunities. Organizations like Export Development Canada and the Business Development Bank of Canada also offer a range of exporting and export financing services.

The Government of Ontario also provides its own international trade programs. In its 2016 Budget, the Government of Ontario announced a three-year, $30 million investment in its Going Global Export Strategy to support exporting in Ontario. Exporting is a key consideration that guides the government’s strategic investments.

In the context of the suite of programs available to support business growth, however, concerns have been raised that Ontario’s firms may not be receiving sufficient public support to engage in international trade—an important determinant of firm growth in Canada. In a recent analysis of Ontario government programs targeted at business growth, ICP found that only six percent of initiatives are designed to encourage international trade. In addition, only half of those initiatives were directed towards businesses in sectors that are most likely to benefit from international trade.61

Engaging more firms in international trading activity will be an essential component of any strategy to encourage scaling.

Anchor companies are not sufficiently engaged in the Canadian marketplace

Participating in the supply chains of “anchor” companies, such as government departments or large private firms, is an important vehicle to growth for Canadian firms.62 This is because the supplier-purchaser relationship between SMEs and large organizations yields significant benefits.

For SMEs, these large customers provide a number of benefits in addition to their direct business: they serve as market validators of a product or service, act as referrals for new business growth, and provide capacity building for their supplier network.63,64 SMEs also provide benefits to anchor customers in the form of firm innovation, research, and new product development.65

In Canada, however, the absence of anchor customers is acting as a significant impediment to the growth of young firms.66,67 For example, government has been reluctant to design procurement policies that favour early-stage Canadian firms.68 In a 2011 review, the Independent Panel on Federal Support to Research and Development identified that there was a significant “procurement gap” in Canada to stimulate innovation. While the federal government does offer some of this programming, like the Build in Canada Innovation Program, the level of funding is far less than what is allocated by governments in other jurisdictions. For example, the U.S. Small Business Innovation Research Program requires major government departments to set aside 2.5 percent of their internal R&D funding (between $2 and $3 billion) for contracts with start-ups.69

At the same time, small firms interested in winning public procurement contracts struggle with the demands of applying for government procurement opportunities. For example, in a recent federal government study, SMEs cited volumes of paperwork, bidding costs, and clarity of solicitation documents as top barriers to participation and involvement in public procurement.70 This was echoed in the 2014 Survey on Financing and Growth of SMEs, where businesses that did not sell to the government cited lack of awareness of opportunities and a complicated or time consuming process as key barriers.

There is insufficient data to monitor the effectiveness of policy responses

To develop appropriate responses to Ontario’s scaling up challenge and monitor their effectiveness, decisionmakers must be equipped with sufficient information. Where do financing gaps exist? How do they vary by sector? Currently, Ontario does not collect and/or publicize this information.

Even for those existing initiatives that are aimed at creating the next generation of large and innovative firms, we are not collecting and/or publicizing the necessary data. Most notably, Ontario does not publicize the outcomes of the province’s network of business incubators and accelerators in a standardized way. A recent report conducted by the DEEP Centre concluded that, “in the absence of detailed and reliable nationwide data, it is not possible to infer much at all about the broader economic impact of SAOs in Canada”.71

The academic literature on high-growth firms has not provided clear answers to the questions of how and why firms achieve growth.72 Fully understanding the key barriers to scaling requires a more comprehensive understanding of what factors determine firm size, and how these factors might vary by sector. To provide more effective supports to address to the scale up challenge, this kind of information will be critical.

In this section, we have attempted to identify the main barriers preventing businesses from scaling up in Ontario. These barriers speak to business challenges across a range of different policy areas, including taxation, immigration, and trade. How can we begin to address them? The next section provides some options.

c Survey conducted online between March 3 and April 11, 2016. N=359.

RECOMMENDATIONS

Research conducted by the OCC and a number of other organizations reveals multiple barriers inhibiting businesses’ ability to scale up in Canada. Encouraging more firms to rapidly grow requires a concerted effort to break down these barriers. In this section, the OCC presents a set of recommendations to spark a public discussion on the specific actions government, the business community, and other actors need to take to address the scale up challenge. The recommendations below are neither all-encompassing nor exhaustive, but will help guide the Government of Ontario as it embarks on its Business Growth Initiative. They can also guide the federal government as it develops an innovation agenda for Canada.

Improve access to talent by working with the federal government to create a scale up visa to accelerate access to qualified international candidates

As discussed earlier, high-growth firms often require individuals with specific skill sets that can take them successfully through periods of rapid growth—individuals that are currently scarce in Canada’s labour market. Government could help facilitate the growth of scale ups by making the process by which companies are able to bring on international talent quicker and less cumbersome. We recommend the creation of a scale up visa to facilitate the international talent recruitment process. This visa could be offered by creating a scale up designation via Canada’s International Mobility Program—an element of the Temporary Foreign Worker program that exempts foreign nationals from completing labour market impact assessment before being able to work in Canada.

Improve access to financing by first gaining a better understanding of existing gaps

While access to financing is a frequent point of discussion in the context of scaling up, obtaining financing is not the top barrier to growth for the broader business community. However, more acute gaps may exist for businesses who request certain types of capital, or operate in specific sectors. To gain a comprehensive understanding of this issue, and the role for different actors in addressing it, a more rigorous investigation of the specific gaps in financing in Ontario is needed.

Ensure public programs and incentives are aligned to encourage businesses to scale up

To encourage more firms to scale up in Ontario and reap the economic benefits of this activity, a concerted effort must be made to reassess how governments allocate their scarce resources to encourage scaling. In discussions with the OCC, many businesses and other organizations cited a need to provide more support to firms that are already scaling. The OCC recommends:

a) Focusing supports on high-growth firms and those with high-growth potential

Ontario businesses have access to a wide range of federal and provincial business support programs, but these can be uncoordinated and not oriented towards factors that support business growth. In their 2016 budgets, both the federal and provincial governments announced new initiatives to focus more resources and provide tailored support for select high-growth firms. From the perspective of the OCC, these are very encouraging steps. Alongside these new initiatives, however, we encourage the federal and provincial governments to take a broader look at how the suite of business programs that they offer can be consolidated and re-oriented to support a broader group of high-growth and high-growth potential firms.

b) Delaying taxation on corporate income growth

Currently, Ontario’s tax system contains few incentives to encourage firm growth. In part, this issue warrants a longer-term discussion about the structure of the corporate income tax regime. In the short-term, there are simpler proposals that may be easier to implement. In particular, the OCC encourages Ontario to explore ICP’s recommendation to exempt firms’ incremental income from corporate income tax in a given year.73 With this exemption, firms that are growing can reinvest their retained income into their business. Conditions to qualify for the exemption could be set to target higher-growth firms; for example, it could require a minimum rate of income growth over the previous year.

Encourage greater international trade activity by:

a) Increasing support for businesses seeking to engage in international trade

Exporting is a key determinant of firm growth in Ontario. Through its Going Global Export Strategy, the government currently offers support to Ontario firms starting to export or expanding their operations. This group of firms should be supported in a more substantive way—by seeking government support for exporting, they have already expressed their desire to grow. In its 2016 budget, the provincial government committed to investing $10 million annually over the next three years to support its export strategy. The OCC recommends that Ontario boost its investment to support these firms who could make up the next generation of high-growth firms. This increased investment could be coupled with an effort to reconcile government’s suite of business support programs to support high-growth potential firms, as recommended earlier.

b) Linking more business support programs to international trade

While exporting is a key determinant of firm growth, most of the province’s business support programs do not directly support international trade. As such, the government should actively encourage this amongst a broader group of businesses alongside increasing support for firms already interested in exporting. To do so, we recommend that Ontario make international trade a core component of a greater proportion of its business support program offerings.

Improve access to anchor customers by:

a) Leveraging public sector procurement to strategically invest in growing businesses

In its 2016 budget, the provincial government committed to the creation of a pilot program to purchase successful new technologies from emerging companies. The OCC supports this shift in approach to procurement, something we have called for in previous reports.74 To support a larger number of high-growth and high-growth potential firms in Ontario, we encourage the government to quickly transition from a pilot program to a larger scale, government-wide initiative like the U.S. Small Business Innovation and Research program. Specifically, the government should designate a small percentage of all public procurement spending to support innovative businesses in Ontario.

b) As a business community, viewing partnerships between Ontario’s small and growing firms as competitive business development opportunities

As described earlier, large private companies in Canada provide a critical market for smaller firms. Importantly, these companies reap significant benefits from their relationships with smaller firms. Large Ontario firms need to more actively consider the benefits that would accrue to both them and their SME and potential high-growth suppliers through more intimate supply-chain relationships.

Enable accurate measurement of the scale up challenge and monitoring of public policy responses by working with Statistics Canada and industry groups to collect and publicize relevant data

Ontario lacks sufficient data to characterize the scale up challenge and successfully monitor how its policy responses perform. If we are to tackle the scale up challenge, improving the collection and availability of data is imperative. As a start, the Government of Ontario should work with industry groups to collect and make public more detailed information about Ontario’s high-growth and high-growth potential firms to better understand which types of businesses are most affected by particular barriers to growth. In addition, the Government of Ontario should work with Statistics Canada to obtain and release more detailed firm-level data for policymakers and other stakeholders to evaluate the effectiveness of new policies over time. The Cambridge Cluster Map, which helps to guide public and private investment by providing up-to-date information on the performance of technology firms in Cambridge, U.K., could be an interesting model to emulate.75

CONCLUSION

Over the past decade, Ontario and Canada have seen considerable growth in entrepreneurship and the start-up ecosystem. This is largely due to a concerted investment effort from both the public and private sector. While we continue to support a growing cohort of homegrown entrepreneurs and businesses, barriers in Ontario are preventing many fi rms from realizing their growth potential and scaling up their business. These barriers include a limited pool of talent, gaps in the availability of fi nancing, misaligned supports and incentives, and others. As a result, Ontario is failing to reap many of the economic rewards associated with the proliferation of high-growth firms.

We hope that this report has shed light on the scale up challenge facing Ontario, and that our recommendations will help to guide the scaling up conversation in the province. As the governments of Canada and Ontario move forward with strategies to support business growth, we encourage them to continue to remain engaged with the Ontario Chamber of Commerce and the province’s business community to develop the solutions that will allow for the creation of a sustainable, innovation-driven economy over the long-term.

WORKS CITED

- Centre for Digital Entrepreneurship and Economic Performance (DEEP Centre). 2015a. A lynchpin in Canada’s economic future: accelerating growth and innovation with a world-class business acceleration ecosystem. http://deepcentre.com/wordpress/wp-content/uploads/2015/10/DEEP-Centre-BABI-5-Capstone-Accelerating-Growth-and-Innovation-September-20151.pdf

- Ruffolo, J. 2016. Canada must learn to scale up to turn innovators into employers. The Globe and Mail. January 20, 2016. http://www.theglobeandmail.com/report-on-business/rob-commentary/canada-must-learn-to-scale-up-to-turn-innovators-into-employers/article28269017/

- Langford, C. and P. Josty. 2015. 2014 GEM Canada national report. Global Entrepreneurship Monitor. http://www.gemconsortium.org/report

- Ruffolo 2016

- Langford and Josty 2015

- Davis, C., Valliere, D., Lin, H., and N. Wolff. 2014. 2013 GEM Ontario Report. Global Entrepreneurship Monitor. http://www.gemconsortium.org/report

- DEEP Centre 2015a

- Ruffolo 2016

- National Endowment for Science, Technology, and the Arts (NESTA). 2009. The vital 6 per cent: how high-growth innovative businesses generate prosperity and jobs. http://www.nesta.org.uk/publications/vital-6

- Coutu, S. 2014. The scale-up report on UK economic growth. http://www.scaleupreport.org/

- Baldwin, J., Leung, D., and L. Rispoli. 2014. Canada-United States labour productivity gap across firm size classes. Statistics Canada. http://www.statcan.gc.ca/pub/15-206-x/15-206-x2014033-eng.pdf

- Centre for Digital Entrepreneurship and Economic Performance (DEEP Centre). 2014. Canada’s billion dollar firms: contributions, challenges, and opportunities. http://deepcentre.com/wordpress/wp-content/uploads/2014/07/DEEP-Centre-Canadas-Billion-Dollar-Firms-July-2014_ENG.pdf

- DEEP Centre 2015a

- Business Development Bank of Canada (BDC). 2015a. SMEs and growth: challenges and winning strategies. https://www.bdc.ca/en/about/sme_research/pages/sme-growth-challenges-winning-strategies.aspx?ref=shorturl-growth

- Dixon, J., and A-M. Rollin. 2014. The distribution of employment growth rates in Canada: the role of high-growth and rapidly shrinking firms. http://www.statcan.gc.ca/pub/11f0027m/11f0027m2014091-eng.pdf

- Parsley, C. and D. Halabisky. 2008. Profile of growth firms: a summary of Industry Canada research. https://www.ic.gc.ca/eic/site/061.nsf/eng/h_rd02278.html

- NESTA 2009

- Stangler, D. 2010. High-growth firms and the future of the American economy. Kauffman Foundation. http://www.kauffman.org/whatwe-do/research/firm-formation-and-growth-series/highgrowth-firms-and-the-future-of-the-american-economy

- Kong, E. and R. Morris. 2014. The critical 9 percent: why scaleup companies are vital for job creation in Jordan. Endeavor Insight. https://issuu.com/endeavorglobal1/docs/the_critical_9_percent_report__jord

- Kong, E. and R. Morris. 2015. The critical 5 percent: why scaleup companies are vital for job creation in Kenya. Endeavor Insight. https://issuu.com/endeavorglobal1/docs/the_critical_5___kenya_

- Acs, Z., Parsons, W., and S. Tracy. 2008. High-impact firms: gazelles revisited. U.S. Small Business Administration. https://www.sba.gov/content/high-impact-firms-gazelles-revisited

- Parsley and Halabisky 2008

- NESTA 2009

- Coutu 2014

- Institute for Competitiveness & Prosperity (ICP). 2012. Small business, entrepreneurship, and innovation. http://www.competeprosper.ca/work/working_papers/small_business_entrepreneurship_and_innovation

- ICP 2012

- Baldwin et al. 2014

- Ibid.

- Songsakul, T., Lau, B., and D. Boothby. 2008. Firm size and research and development opportunities: a Canada-U.S. comparison. Industry Canada. https://www.ic.gc.ca/eic/site/eas-aes.nsf/eng/ra02065.html

- ICP 2012

- Ibid.

- Institute for Competitiveness & Prosperity (ICP). 2016. A place to grow: scaling up Ontario’s firms. http://www.competeprosper.ca/work/working_papers/working_paper_23

- DEEP Centre 2014

- Business Development Bank of Canada (BDC). 2015b. High-impact firms: accelerating Canadian competitiveness. https://www.bdc.ca/en/about/what-we-do/high-impact-firms/pages/default.aspx

- Herman, D. and S. Marion. 2016. Scaling success: tackling the management gap in Canada’s technology sector. Lazaridis Institute for the Management of Technology Enterprises.

- Ibid.

- BDC 2015b

- Coutu 2014

- BDC 2015b

- Ibid.

- Canadian Venture Capital and Private Equity Association (CVCA). 2016. 2015 Canadian venture capital market overview. http://www.cvca.ca/venture-capital-2015/

- ICP 2016

- ICP 2012

- ICP 2016

- Dachis, B. and J. Lester. 2015. Small business preferences as a barrier to growth: not so tall after all. C.D. Howe Institute. https://www.cdhowe.org/pdf/commentary_426.pdf

- Chen, D. and J. Mintz. 2011. Small business taxation: revamping incentives to encourage growth. The School of Public Policy, University of Calgary. http://policyschool.ucalgary.ca/sites/default/files/research/mintzchen-small-business-tax-c_0.pdf

- Dachis and Lester 2015

- Ibid.

- Ibid.

- Vettese, F. 2016. It’s time for the Canadian government to reward job creators of all sizes. The Globe and Mail. March 14, 2016. http://www.theglobeandmail.com/report-on-business/rob-commentary/its-time-for-the-canadian-government-to-reward-job-creators-of-allsizes/article29203148/

- Dachis and Lester 2015

- ICP 2016

- Parsley and Halabisky 2008

- Parsley, C. and S. Djukic. 2010. The state of entrepreneurship in Canada. https://www.ic.gc.ca/eic/site/061.nsf/vwapj/SEC-EEC_eng.pdf/$file/SEC-EEC_eng.pdf

- Ibid.

- Ibid.

- BDC 2015b

- Ibid.

- DEEP Centre 2014

- Ibid.

- ICP 2016

- DEEP Centre 2015b

- Ibid.

- ICP 2012

- Ibid.

- Ibid.

- Klugman, I. and K. Lynch. 2015. There’s no better time for Canada to buy into its own innovators. The Globe and Mail. December 24, 2015. http://www.theglobeandmail.com/report-on-business/rob-commentary/theres-no-better-time-for-canada-to-buy-into-its-owninnovators/article27930866/

- Beech, T., Donoghue, B., Hungerford, G., Okhowat, A., and S. Wells. 2011. Fuelling Canada’s economic success: a national strategy for high-growth entrepreneurship. Action Canada. http://www.actioncanada.ca/wp-content/uploads/2014/04/

FuellingCanadasEconomicSuccess-ANationalStrategyForHigh-GrowthEntrepreneurship.pdf - Independent Panel on Federal Support to Research and Development. 2011. Innovation Canada: a call to action. http://rd-review.ca/eic/site/033.nsf/eng/h_00287.html

- Public Works and Government Services Canada (PWGSC). 2013. 2012 study of participation of small and medium enterprises in federal procurement. https://buyandsell.gc.ca/sites/buyandsell.gc.ca/files/pwgsc_study-sme-federal-procurement_2012_0.html

- DEEP Centre 2015a

- Brown, R., Mason, C., and S. Mawson. 2014. Increasing ‘the vital 6 percent’: designing effective public policy to support high growth firms. NESTA Working Paper 14/01. http://www.nesta.org.uk/publications/increasing-vital-6-percent-designing-effective-public-policysupport-high-growth-firms

- ICP 2016

- Deyanska, A., and J. Hjartarson. 2014. Spend smarter, not more: leveraging the power of public procurement. Ontario Chamber of Commerce. http://www.occ.ca/Publications/SpendSmartNotMore_online.pdf

- The University Enterprise Network. 2013. Cambridge Cluster Map. University of Cambridge. http://www.enterprisenetwork.group.cam.ac.uk/news/217

ABOUT THE ONTARIO CHAMBER OF COMMERCE

For more than a century, the Ontario Chamber of Commerce (OCC) has been the independent, non-partisan voice of Ontario business. Our mission is to support economic growth in Ontario by defending business priorities at Queen’s Park on behalf of our network’s diverse 60,000 members.

From innovative SMEs to established multi-national corporations and industry associations, the OCC is committed to working with our members to improve business competitiveness across all sectors. We represent local chambers of commerce and boards of trade in over 135 communities across Ontario, steering public policy conversations provincially and within local communities. Through our focused programs and services, we enable companies to grow at home and in export markets.

The OCC provides exclusive support, networking opportunities, and access to innovative insight and analysis for our members. Through our export programs, we have approved over 1,300 applications, and companies have reported results of over $250 million in export sales.

The OCC is Ontario’s business advocate.

Author: Scott Boutilier, Senior Policy Analyst

ISBN: 978-1-928052-30-2

©2016 Ontario Chamber of Commerce