Government of Ontario announces new business support

Ontario COVID-19 Small Business Relief Grant

The Ontario COVID-19 Small Business Relief Grant is for small businesses that are subject to closure under modified Step Two of Roadmap to Reopen beginning January 5, 2022. It will provide eligible small businesses with a one-time grant payment of $10,000.

Eligible small businesses will include:

- Restaurants and bars

- Facilities for indoor sports and recreational fitness activities (including fitness centres and gyms)

- Performing arts venues and cinemas, museums, galleries, aquariums, zoos, science centres, landmarks, historic sites, botanical gardens and similar attractions

- Meeting or event spaces

- Tour and guide services

- Conference centres and convention centres.

Eligible businesses that qualified for the Ontario Small Business Support Grant and that are subject to closure under modified Step Two of Roadmap to Reopen will be pre-screened to verify eligibility and will not need to apply to the new program. Newly established and newly eligible small businesses will need to apply once the application portal opens in the coming weeks. Small businesses who qualify can expect to receive their payment in February.

Electricity Rate Relief Support

For 21 days, starting at 12:01 am on Tuesday, January 18, 2022, electricity prices will be set 24 hours a day at the current off-peak rate of 8.2 cents per kilowatt-hour, which is less than half the cost of the current on-peak rate. The off-peak rate will apply automatically to residential, small businesses and farms who pay regulated rates set by the Ontario Energy Board and get a bill from a utility and will benefit customers on both Time-of-Use and Tiered rate plans. This will provide immediate savings for families, small businesses and farms as all Ontarians work together to slow the spread of the Omicron variant.

Ontario Business Costs Rebate Program

Online applications for the Ontario Business Costs Rebate Program will open on January 18. This program will provide eligible businesses that are required to close or reduce capacity with rebate payments for up to 100 per cent of the property tax and energy costs they incur while subject to public health measures in response to the Omicron variant.

Eligible businesses required to close for indoor activities, such as restaurants and gyms, will receive a rebate payment equivalent to 100 per cent of their costs. Those required to reduce capacity to 50 per cent, such as smaller retail stores, will receive a rebate payment equivalent to 50 per cent of their costs. A complete list of eligible businesses will be provided prior to the launch of the application portal.

Improving Cash Flow for Ontario Businesses

The government is providing up to $7.5 billion through a six-month interest- and penalty-free period starting January 1, 2022 for Ontario businesses to make payments for most provincially administered taxes.

The Province continues to call on the federal government to match provincial tax deferral efforts by allowing small businesses impacted by public health restrictions to defer their HST remittances for a period of six months.

Read the Government of Ontario’s media release here.

GNCC welcomes new business supports, but some in need are ineligible

The GNCC today issued a media release regarding new supports for businesses affected by COVID-related restrictions and closures.

These included the Ontario COVID-19 Small Business Relief Grant for small businesses subject to closure under the modified Step Two of the Roadmap to Reopen. It will provide eligible small businesses with a grant payment of $10,000.

Additional reductions to electricity costs were also announced along with a rebate program.

“This grant will be a significant help to businesses that have been forced to close owing to COVID-related restrictions, and it is most welcome at this difficult time,” said Mishka Balsom, CEO of the GNCC. “However, the program does not cover all the businesses that were restricted on January 3rd, and many will be without help.”

Examples of businesses that will be severely impacted but are ineligible for the relief grant include food suppliers for restaurants, or hair salons and other personal services currently working at 50% capacity.

Additionally, property tax deferrals and energy bill relief are only useful to those businesses which own their premises and/or pay their own energy bills. For businesses that rent a property, the program relies on the goodwill of a landlord to pass the savings on.

The GNCC has called on the Government of Ontario to extend relief to all affected businesses under the Reopening Ontario Act regulations of January 3rd.

Click here to read the GNCC’s letter to the Honourable Peter Bethlenfalvy, Minister of Finance.

Government of Canada extends eligibility for Lockdown Program and Worker Lockdown Benefit

Today, through regulatory authorities that were approved with the passage of Bill C-2, the Government of Canada announced its intent to temporarily expand the definition of a lockdown so that wage and rent support programs will apply to workers and businesses that see capacity restricted by 50 per cent or more.

If you are an employer who has to reduce the capacity of your main business by 50 per cent or more, you will be eligible for the wage and rent subsidy support through the Local Lockdown Program.

The Government of Canada is also lowering the revenue decline threshold from 40 per cent to 25 per cent. Eligible employers will receive wage and rent subsidy support from 25 per cent up to 75 per cent, depending on how much revenue they have lost. An organization only needs to demonstrate revenue loss during the current month, compared with 2019.

Employers will be able to apply for these expanded support programs after the end of each program period, in exactly the same way that they received wage and rent subsidy support when those programs were launched.

Click here to read the Deputy Prime Minister’s remarks.

Click here for more information including how to apply.

Niagara sees employment rate drop in late 2021

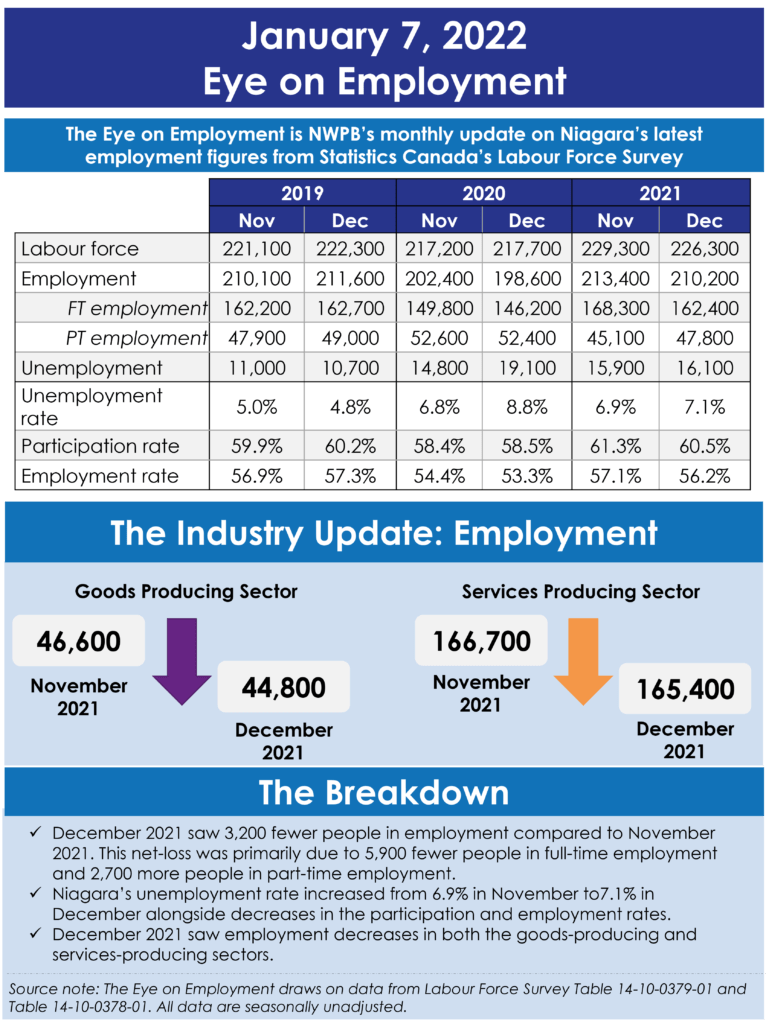

Today’s update from Statistics Canada’s Labour Force Survey shows that Niagara saw an overall employment decrease between November and December 2021. Locally, Niagara Workforce Planning Board noted declines in both the participation and employment rates alongside an increase in the unemployment rate. This contrasts the unemployment rate decreases seen provincially and nationally.

These data reflect trends from the week of December 5-11, 2021. Since these data were collected, a variety of pandemic-related changes have occurred, including a provincial shift into a modified Stage 2 of pandemic response due to the spread of the Omicron variant.

Trends to Consider

- Given what we have seen in terms of employment-related impacts of past shutdowns, it will be important to examine potential employment impacts to cohorts we have seen be more impacted throughout prior shutdowns or restrictions (e.g., women and youth); sectors that have been heavily impacted such as accommodations and food services, and wholesale and retail trade; and any potential impacts to sectors such as health care and social assistance, and educational services.

- Discussion around potential labour shortages have been ongoing. In Niagara, December 2021 displayed a decrease in the labour force size which means there were fewer people employed or actively searching for work; however, the unemployment rate increased indicating that a larger portion of individuals in the labour force are still seeking employment. Provincially we see that many industries had a decrease in the unemployment rate between November and December 2021 (Table 1). For example, across Ontario the unemployment rate in manufacturing decreased to 2.4% with an increase in employment of over 20,000 individuals which indicates high demand for workers in this sector, and demonstrates the tight labour market.

- Another factor to consider are impacts to individuals’ ability to participate in the labour force due to either temporary sector shutdowns/layoffs or being unable to work due to potential infection with COVD-19. Related to this could be work absences where national level data indicate that the total number of days lost per worker increased throughout 2020 and 2021 compared to prior years (Statistics Canada. Table 14-10-0196-01 )

Click here for more information.

Town of Lincoln launches business support telephone line

The Town of Lincoln has launched a business support line to assist our business community during the Omicron wave of the COVID-19 pandemic. In response to the return to a modified version of Step Two of the Roadmap to Reopen, the Town wants to further support the business community with any questions or concerns related to their business and the COVID-19 pandemic. Lincoln staff are ready to provide information and assistance to businesses in need.

If you have questions or concerns about your business and the COVID-19 pandemic, please contact the Business Support Phone Line at 905.563.2799 ext. 518. The Business Support Phone Line is open Monday to Friday, 8:30 a.m. – 4:30 p.m.

Click here for more information.

Port Colborne accepting grant applications for non-profit organizations

The City of Port Colborne is accepting the first round of grant applications from non-profit organizations until Monday, Jan. 31, 2022.

The granting committee distributes approximately $30,000 annually to non-profit organizations, charitable organizations, and service organizations that benefit the citizens of Port Colborne and enhance the quality of life of the community.

The second due date for applications in 2022 is June 30, 2022; however, organizations can only apply once in a fiscal period.

To download the grant application, visit the city’s website. For more information about the application process and/or grant policy committee, call Nancy Giles, EA to Mayor and CAO at 905-835-2900 x 301 or email mayoradmin@portcolborne.ca.

Reading Recommendations

Execs fear omicron’s impact on employee retention, hiring

Canadian HR Reporter

Most business leaders in the U.S. — 87 per cent — believe their organization could endure an outbreak of the omicron variant of COVID-19.

Eighty-six per cent feel that existing policies and procedures aimed at stopping the spread of COVID-19 in the workplace gave them confidence, finds a survey by SHRM (the Society for Human Resource Management).

“Clearly, this variant is causing significant disruptions across the economy, and business leaders must continue taking steps to protect employees and their families and retain talent,” said Johnny Taylor, Jr., SHRM president and CEO.

“Despite the anxiety, there is good news. Employers are confident the hard work of the last few years — all the planning and safety protocols — will help get them through the twists and turns of the pandemic.”

Nearly 500 employees at the City of Toronto have lost their jobs because of the municipality’s vaccine mandate.

Until we address chronic underfunding, Canada will keep failing at emergency management

The Conversation

The COVID-19 pandemic is different from the disasters Canadians are more familiar with. The public’s confusion partly stems from the fact that the pandemic doesn’t follow the usual pattern of news media coverage featuring stories about first responders dealing with the immediate harm and damage, and then moving on to the next story.

Instead we’ve had almost two years of public health and safety orders that have dramatically changed the way we work, travel and live. While requiring evacuation during a flood or wildfire is common sense, we’ve been dealing with emergency orders that vary across the country, come and go with each wave and have divided communities.

These emergency orders expose how disasters unfold and the status of the emergency management system in Canada. Some of the characters are familiar, like mayors and fire chiefs, while others are equally important even though they are seldom talked about. To understand the role of these emergency managers, we need to understand disasters.

Niagara COVID-19 statistics tracker

Niagara COVID vaccination tracker

Free rapid COVID-19 testing kits are now available to businesses. Visit gncc.ca/workplace-self-screening-kits to learn more and reserve kits for your organization.

For information on rapid testing kits for individuals, click here.

Information on government grants, resources, and programs, policies, forms, and posters for download and use, are available here. The GNCC is here to support you. Contact us with any questions you have.

Through the Daily Updates, the GNCC aims to deliver important business news in a timely manner. We disseminate all news and information we feel will be important to businesses. Inclusion in the Daily Update is not an endorsement by the GNCC.