I usually don’t go off on a tangent nor do I share my views outside of my consulting business experiences and expertise. However, I am getting a little more courage as it relates to speaking your mind and since this article may fit into that category, I call this segment “off the cuff”. As an international management consultant I have worked for and with Chinese, European and western alliances organizations and I have learned a great deal from each and everyone. Now, I’d like to share a thought or two about the fallout of the Ukraine Invasion.

If we believe China’s foreign affairs minister Mr. Wang Yi “relations with Russia and China are rock solid and the friendship between Mr. Xi and Mr. Putin has no boundaries”, well – we will soon find out as Western sanctions lead by the United States of America are about to put that statement to a solid test. Russia has badly underestimated the will of innocent people, economic instabilities and the financial fall out associated with the invasion of a sovereign country. As a result, Russia requires an economic and financial lifeline from China.

Any economic and financial lifeline that Beijing can offer Moscow involves taking a risk and it won’t have the power to reverse the damage of sanctions imposed by the United States and its allies. The United States is by far the biggest economy in the world and its allies depend on it and each other.

When the United States and its allies declared an economic and financial war on Russia after the invasion of the Ukraine, the world wondered what China and North Korea might do to other countries (Taiwan and South Korea). You can take North Korea out of the picture because they are a nuisance at best that can easily be squashed like a bug however; China is different.

When China joined with India and the United Arab Emirates in abstaining on a United Nations resolution condemning Russia’s invasion of Ukraine, Mr. Yi said that the vote was a “forgone conclusion” but, China was calling for an immediate halt to hostilities. He further stated that China was a peaceful neutral country and all countries ought to be at peace. However, China spues the rhetoric that Russia provides and fills their people with Russian created propaganda. It also broadcasts its news to their people in the same manner as Russia.

As a growing global power one of the ways China has extended its influence is by establishing close financial ties with countries unwilling to follow rules dictated by the United States and other Western powers. The thinking was that China would do the same for Russia but, there is just one big problem and that is M-O-N-E-Y.

In order to help Russia evade sanctions China will have to offer a viable substitute to the American dollar. Chinese money is called Renminbi (referred to as the Red Back) and is barely used outside of China. Less than 5% of the worlds business is done using the Renminbi or Yuan. Even Russia and China conduct trade in US dollars and Euros.

What is more; China is the world’s largest exporter of goods and those exports are in sanctionable play should China overtly aid Russia. That is the risk of helping Russia avoid economic disaster. That may be greater for China then any possible reward that it may reap from helping Russia. Much of China’s economy depends on the US dollar and the financial structure that supports it. Chinese companies are active around the globe using the American financial system to pay employees, buy materials, pay debt and make investments.

As the world’s largest exporter, China is paid for its goods mainly in US dollars

(the Green Back). China’s Gross Domestic Product (GDP) is $ 13.72 TR, second only to the US at $ 19.45 TR. They have grown largely due to a high scale of capital investments and massive productivity growth. Since 2000, China’s net worth has soared from $ 156 M to $ 514 TR (all USF) in 2020. China’s world exports are at 20 % of GDP which equals $ 2.75 TR with over 70 % of that going to the United States and its western allies.

So, should Beijing decide to run afoul against the sanctions imposed against Russia, a file of sanctions will be brought against them and place China’s financial stability at risk at a time when its leaders have emphasized economic caution.

Another difficulty for China is the precedence that the US and its western allies have used in the past. These are referred to as “secondary sanctions”. Remember in May of 2017 when Chinese banks dealt with Iran and North Korea – they were penalized by the United States and its western allies via secondary sanctions costing the Republic of China 15 % of GDP. Chinese International Banks have reminded Mr. Xi of these secondary sanctions and are wary that Volvo based in Sweden is owned by a Chinese firm, Tick-Tock which is operated out of Singapore is Chinese owned and Smithfield Foods which is head quartered in Virginia is also Chinese owned.

Also, Chinese firms without legal precedents in the west could be hit by secondary sanctions which take aim at third countries that help the subject of primary ones.

Although the United States and its western allies have not yet used this weapon over Russia it is definitely on the table.

It is true that Chinese leaders could feasibly offer Russia a subservient life line but, it would not be strong enough to help the country survive a financial obliteration from the United States and the alliance.

It could facilitate cross-border transactions allowing China to continue to sell to Moscow many of its goods and make investments in Russia energy firms on the cheap. It could let the Russian central bank cash and some of that $ 140 B that it holds in Chinese bonds. Beijing could even set up a World Bank to help Russian money move around the world like it did for North Korea.

None of these measures would be enough to counterbalance the sanctions against Russia which have included cutting off Russian banks from the global financial system, banning oil and gas imports into US and allied countries while also banning other substantial imports such as diamonds, caviar, grain, etc. China will not save the sinking ship of the Russian economy but, perhaps it will allow her to float a little longer and sink a little more slowly.

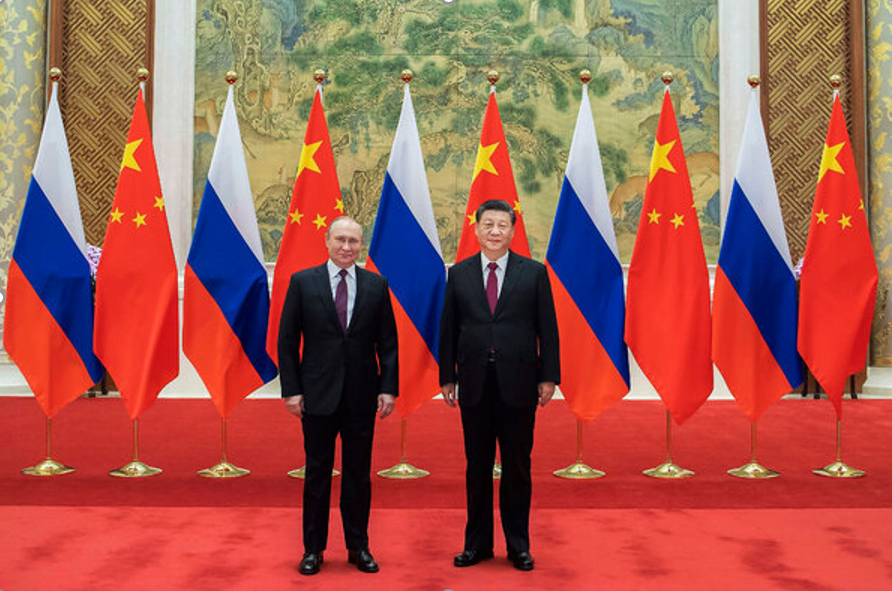

A deepening friendship between Chinese leader, Mr. Xi and Mr. Putin of Russia has helped bring the countries closer together. The warming of diplomatic ties was built on one shared desire – to put an end to what they saw as an American economic monopoly.

When Mr. Xi and Mr. Putin met on the eve of the Beijing Olympics, they declared that the bond between the two countries had no limits. It has been widely rumoured that at that meeting; Mr. Putin informed Mr. Xi of his intention to invade the Ukraine and Mr. Xi asked that he not invade until the Olympics were over. That being said, China is now culpable in the Ukraine invasion.

China has reportedly criticized the moves by the western alliance. The Premier of the State Council of the Republic of China, Mr. Keqiang in the first week of the Ukraine invasion said that; “sanctions will hurt the world’s economy and its recovery and is in no country’s best interest”. That being said; Mr. Keqiang is no fool nor is his boss Mr. Xi. In this world, criticizing is one thing – choosing to go against the global financial order and risking inviting sanctions at home is a totally different animal. Beijing has already given some indication that isn’t willing to do that.

The Chinese Infrastructure Investment Bank said on March 8th that would cut back on financing Russian commodities. Chinese banks are in the process of minimizing their exposure to Russia and in no rush to supply an alternative.

Nevertheless, Mr. Guo Shuqing, Chair, China Banking and Insurance Regulatory Commission Regulator said last week that China will not be part of the sanctioning alliance. In an attempt to play both sides of the fence, Mr. Shuqing stated that it would be business as usual for China and Russia. However, that being said the stakes for China are extremely high, with great risk and with no road back should they threaten and go against the western alliance. As sanctions are stacked upon Mr. Putin and his Russia, maintaining economic ties with Russia will be a disaster for China. Western countries have locked Russia out of the Swift financial messaging and payments system, effectively excluding Russian banks from international transactions.

China has been developing an alternative messaging service for financial institutions to communicate cross-border transactions. But that service operates on a tiny scale and relies partly on technology tangled up in sanctions.

After Visa and Mastercard stopped their operations in Russia, several Russian banks turned to China’s UnionPay, which offers payment options in approximately 165 countries. For China to offer its own payment processing, transactions must not be in US dollars in order to avoid punishment. Then there is the money that Russia has sitting in China. Through central bank reserves, government investments and a long standing loan agreements, Russia can raise from China the equivalent of more than $160 billion, or about 19 months’ worth of Russian sales of oil and natural gas to the European Union and the United States.

A large part of that money — around $140 billion — is tied up in bonds and denominated Renminbi. The rest is tied up in agreements between the two countries’ central banks that each commit to short-term, interest-free loans worth $24 billion in case of an emergency.

A more diplomatically risky option would be for China to launder money for Russia through a small Chinese bank set up specifically to evade sanctions. This is what China National Petroleum Corporation did in 2009 when it bought a small bank in China’s northwestern province of Xinjiang and renamed it Bank of Kunlun. The bank enabled Iran to conduct hundreds of millions of dollar transactions. That did not work out well for China.

In a similar scenario, a Chinese oil company could pay a shell company and its corporate officers in China a very large “consulting fee” to trade oil on its behalf, instead of paying a Russian oil company directly for crude oil. Such an operation would be shut down by the US and it’s alliance and the risk of sanctions against China comes back into play. That is what happened with Bank of Kunlun after the U.S. Treasury Board sanctioned it back in 2012, sanctions that lasted two plus years.

In another scenario, Chinese companies with state backing could scoop up the West’s stakes in some of Russia’s biggest oil and gas companies. American and European giants like Shell, British Petroleum, Exxon have said they will exit their joint ventures in Russia over the invasion, but there are not a lot of buyers other than Chinese state owned enterprises.

“You’ve got some of the most valuable energy companies in the world now trading at mere fractions of their real value,” said Taylor Loeb, a China analyst at Trivium, a consulting firm. “Developed countries won’t touch these companies. That basically only leaves China. Although such a move will be really bad public relations for China, the price may just be too good to pass up.” This scenario may also be applicable to the fast food market sector.

Even as Beijing contemplates just how far it is willing to go to maintain its “no limit” friendship with Russia, there is one harsh reality: neither the Renminbi nor the Yuan can save Russia’s own currency, the Ruble. The Ruble is plunging like an eighteen wheeler over the side of Whistler Mountain and has already erased much of the country’s wealth.

Chinese officials must juggle several key priorities in order to accommodate Russia’s economic and financial needs and are more than willing to facilitate an end to the Ukraine Invasion. China wants to see Russia survive these sanctions, in order to teach the US and their allies that they are not a magic weapon but, are anxious to limit or escape any and all collateral damage to Chinese interests in the process.

Long term China wants its financial system to be shielded from Western influences and in doing so, cannot take Russia along for the ride. China will aim to improve its dependency on the Western Nations and diversify its $ 3.3 TR of reserve holdings out of the Western currency by investing in commodities and convince foreign firms and governments to issue more securities in China’s capital markets. In doing so they will be able to create a new pool assets for China to buy. Russia’s only hope is that they can hang onto China’s coattails and China can bail them out but, don’t count on it. Time is running out on Mr. Putin and his debacle and Chinese officials although they won’t say it publicly have no desire to take the risks that come along with the Russian society.

Perhaps Mr. Putin and his team of cronies will look to the Cryptocurrency to save them.

About The Author.

Nicholas Pollice is President of The Pollice Management Consulting Group located in Niagara, Ontario, Canada. An international facilitator, presenter and consultant, he is known as an operations management leader and coach. Nicholas conducts programs in leadership, supervision, communication, negotiation, conflict resolution and strategic planning. He has been a international consultant since 1989 and is the author of several professional publications. His presentations have been consistently ranked in the top 10% throughout North America. See Nicholas’ bio, his other publications and services on the PMCG. Website at www.pollicemanagement.com